Written by: Nicole Holzhauer

Recently in AP Economics we have been talking a lot about our national debt. My peers and I had a ton of questions about it and so I thought it would be a perfect topic to research for my blog. Just to give you an idea of how bad our debt is check out this link: (http://www.usdebtclock.org/). It is hard to comprehend how huge our national debt is because it is constantly increasing. America’s debt is the largest that exists for a single country. The debt is now greater than what we can produce in an entire year known as the gross domestic product.

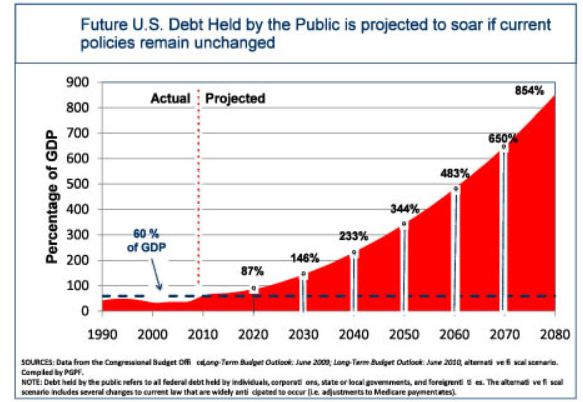

Here is a graph that was made in 2010 that projected 2020’s debt to be about 87% of GDP, but here we are today in 2018 looking back at 2017 when the national debt was equivalent to about 105.40% of GDP. The amount this number has increased is very concerning for the United States. In 1988, the national debt was only 50% of GDP. So how did this number get so big?

Here is a graph that was made in 2010 that projected 2020’s debt to be about 87% of GDP, but here we are today in 2018 looking back at 2017 when the national debt was equivalent to about 105.40% of GDP. The amount this number has increased is very concerning for the United States. In 1988, the national debt was only 50% of GDP. So how did this number get so big?According to “The Balance”, there are several main reasons why our debt got so large. First, the debt can be attributed to federal budget deficits which occur when expenditures exceed total revenue. Second, presidents borrow from the Social Security Trust Fund which makes their deficits look smaller, but the real amount owed still shows up in our debt. Basically, our government owes itself. Third, the government keeps interests rates low and fourth, Congress increased the debt ceiling after it started getting hard to maintain. As for the short run, we benefit from the deficit spending of the government. We need defense equipment, new construction, health care, and much more that contributes to GDP. As for the long run, things do not look as great. If the Social Security Trust Fund does not cover retirement benefits for the baby boomer population, taxes will most likely increase to make up for it, or they will cut out on promised benefits for people.

I bet you’re wondering how we are going to decrease this debt. The first way, which may seem obvious is to cut spending. The only problem with this is it would slow economic growth and decrease GDP. As we know GDP is consumer spending + investments + government spending + exports - imports. A key part of that equation is government spending. Next, the government could raise taxes, but this may also slow economic growth if businesses held back because of it. Another option would be to work to drive GDP to grow faster than the national debt. The only problem with this is that there is no way to for sure increase GDP besides through government spending, which would increase the national debt. Finally, we could shift our government spending to areas that create the most jobs such as construction work or education. We will most likely not pay back our debt any time soon because it is almost impossible to be debt free especially with the rate it is increasing. Although the national debt can be a little scary to think about, we luckily are not at a crisis level yet.

Bibliography

Amadeo, Kimberly. “Will the U.S. Debt Ever Be Paid Off?” The Balance, www.thebalance.com/will-the-u-s-debt-ever-be-paid-off-3970473.

“Increase in the National Debt.” GVDC, www.gvdc.org/Natl_Debt_Chart.html.

Tepper, Taylor. “5 Things Most People Don't Understand About the National Debt.” Time, Time, time.com/money/4293910/national-debt-investors/.

“United States Gross Federal Debt to GDP 1940-2018 | Data | Chart.” Trading Economics, tradingeconomics.com/united-states/government-debt-to-gdp.

I've also seen a lot of coverage about the U.S. debt recently and I've grown to wonder if maintaining debt is actually an issue. From the scant research that I've done it seems like a lot of our debt is to ourselves, and the rest of it which is foreign investments is actually stimulating the economy since that means other countries need to pay attention and act within the U.S. In addition, the U.S. Dollar is currently the international standard for currency which makes the U.S. a very safe investment.

ReplyDeleteIf you want to start a new company or build your new house then a personal loan will not enough for you. For this, you can take help by taking quick cash loan online. You may get the money from a perfect lender on the next day of filling out an online form. There is no need for physical involvement or mortgage.

ReplyDelete50Invest with 0$ and get a returns of 5,000$ within seven business working days.

DeleteWhy wasting your precious time online looking for a loan? When there is an opportunity for you to invest with 500$ and get a returns of 5,000$ within seven business working days. Contact us now for more information if interested on how you can earn big with just little amount. This is all about investing into Crude Oil and Gas Business.

Email: totalinvestmentcompany@gmmail.co