Is the Lottery worth it?

Written by: Megan F.

The lottery is a get a rich quick scheme that leaves lottery winners in debt. According to benzinga, “Nearly one-third of U.S.lottery winners declare bankruptcy, often within just a few years of their big win,” That is not nearly enough of time that this money is supposed to last. Millions of dollars disappearing like a magic act only to end up when you have started but you have dug yourself into a bigger hole. According to a study by Wolf Street “....... was $500,000 in debt and filed for bankruptcy in the early 1990s, according to Bankrate.” The mentality of the people that win the lottery think “It’s okay I have money” but that way of living can easily slip away from you really fast. Many Americans take part in this adrenaline rush. According to the lottery tickets invest money, “ The average American spends about $223.04 per year on lottery tickets, loan marketplace LendEDU found in a report that calculated its average by dividing the 2016 lottery revenue by the U.S. population (325.7 million)”{(Time). The $ 223.04 that you could spend investing in your future. There are much better outcomes in winning the lottery if the winner knew where to put their money.

Although this game is all anticipation and disappointment until you win, or is it just better to invest. In the article why picking stocks is only slightly better than playing the lottery, they go in-depth on why it’s better to pick stocks than play this money-sucking game. The article states, “ The good news: Yes, buying one stock gives you better odds than buying a lottery ticket”(Money Market). A wise man told me that you can’t put all of your eggs in one basket. What if you feel the need to put all of your eggs in the basket because of the outcome that will reward you? Of course, buying a stock is going to give you a better chance as a better outcome for your money. According to What are the odds, 1 in 13,983,816”(wonderopolis)Those numbers are the odds of winning the lottery. It is fun but this gamble should not involve your life revolving around it. Advice for the people that may need it put your money in a certificate of deposit or in the money market to increase your earnings. This advice should on;y help you gain money and not losing the money to the lottery.

Who buys the most lottery tickets?

Not only is this rescue mind trick lead to bankruptcy it can be bad for your budget. According to think process, “ One study found that a reason for this is that “lotteries set off a vicious cycle that not only exploits low-income individuals’ desires to escape poverty but also directly prevents them from improving upon their financial situations.” This study proves that poor people are trying to get money to pay bills and be out of debt. Every ticket that doesn’t win is less and less money that is going towards saving, their family, and their budget. People who participate in the lottery are more likely to be poor rather than on the wealthier side of things.

Where does the money from the lottery usually go?

Have you ever been asked what you would do if you had won the lottery? A popular question that as children were young we were expected to provide an answer to this open-ended question. According to Think Process, “Lottery winnings have led some to drugs, bankruptcy, and family fractures” With a large sum of money things can get out of hand pretty quickly. This pattern is not only known to the gamblers and lottery winners but also football players. According to Money, “78% of former NFL players have gone bankrupt or are under financial stress because of joblessness or divorce” Football players are meant to play football so managing money isn’t a strong suit of theirs. Most football players hire other people to manage their money and most of their money is going to the people that are managing it. In the long run, it would be better to take care of the money individually and take up a personal finance class wouldn’t hurt.

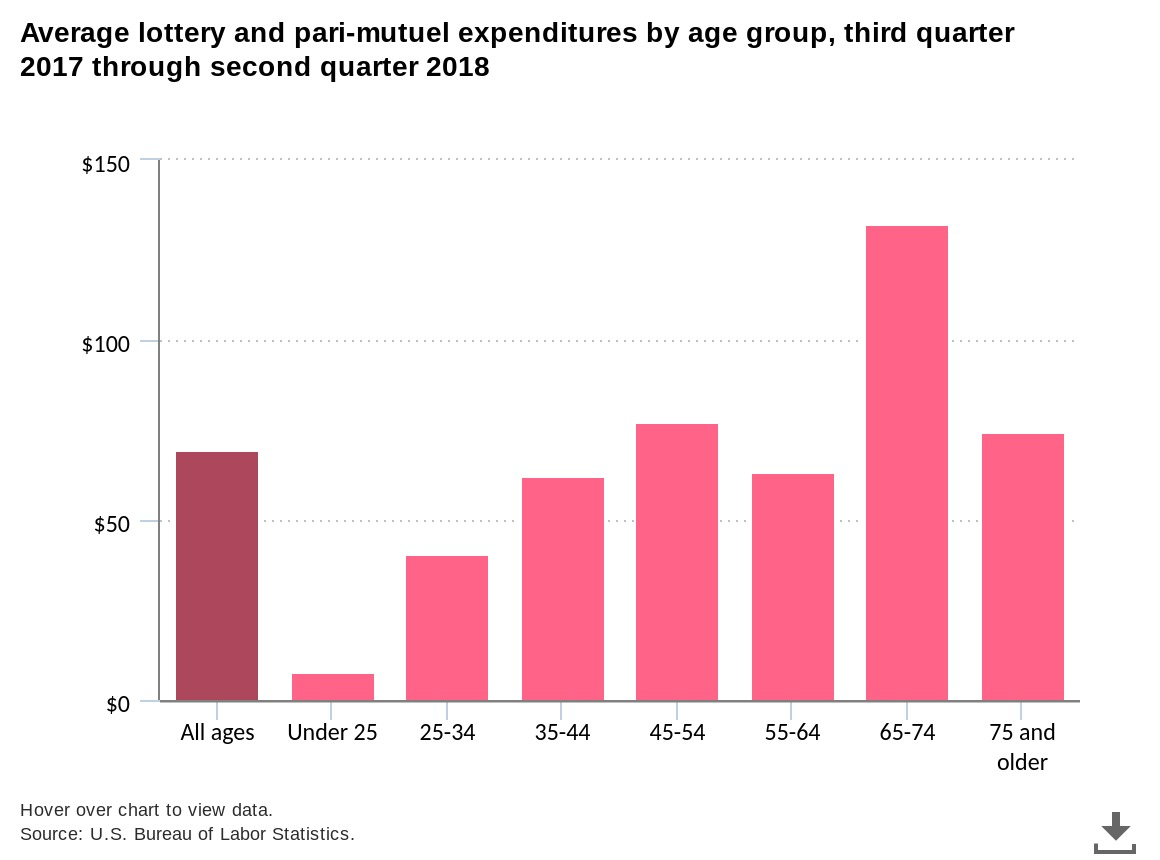

Does age play a role in how much people will pay for lottery tickets?

I thought young people would have bought more lottery tickets because they like to take risks and the rush that follows it. Although older people don’t have to worry about as much as younger people that are starting families. I think that young people are scared to lose their money and they want to save as much as possible. They are saving money for their debt from college and also for the kids that they are going to have. In the chart, you see that after 65-74 years it decreases. The decreasing is probably from the fact that they won’t have time to use the large sum of the money. They are preparing to not live many more years. $7.55 seems so little when you think of putting money towards the lottery. More people are more comfortable at the age of 65 to put money towards the lottery. The younger the lottery buyers are, are more likely to be poor.

What if we looked at the psychology of risk?

What happens to the brain that allows us as humans to pursue the risks we do? According to Are You A High-Risk Investor? A Brain Scan May Soon Be Able To Tell, “ The researchers studied 108 healthy young adults, first giving them detailed questionnaires featuring 120 different scenarios involving the risk of making more or less money to assess their comfort with financial choices. These scenarios gave participants four seconds to make a choice between a 100% certain smaller financial reward (e.g., $20) or a probability of receiving a larger reward, the amount and chance of which varied in each of the 120 trials (e.g., 48% chance of receiving $80). The scientists then used this data to place individuals on a wide spectrum of risk tolerance, ranging from extremely risk-averse to extremely risk-seeking” (Forbes). Some people like to see how far their money can go in a short amount of time. Some people are wiser by investing and saving their money.

Inside the brain

As humans, we like the odds of winning and the excitement that comes with it. According to Gambling addicts arise from a mix of flawed thinking, brain chemistry, and habitual behavior, “A pigeon can become a pathological gambler, just as a person can," the late Skinner, who famously trained birds to guide World War II missiles to their targets, once assured an interviewer”(Cleveland). Now that this study has been done it shows that humans are not the only ones who like the risk. According to this is your brain on a lottery ticket, “ The odds of winning the lottery seem dismal – a joke, really – when you haven’t bought a ticket. You once heard the chances of getting struck by lightning, twice, were better”(manreppeler). Our minds work in a weird way we don’t naturally think about the probability of winning but what the dream has to offer and it is for sale. It is the thought of the question of what would I do with the money? What would I use it on?.

Problem and Action Steps

Is the lottery reassuring to our money problems? According to should I play the lottery, “ A WebMath study reported that one-third of Americans believe the lottery is the only way to become financially stable. One-third. One hundred or so million people who believe that lottery ticket is their only path to financial success”.( planner search) As humans it is sometimes hard to fathom how far things really are. Winning the lottery is one thing humans can get a grasp of how far it really is. It is a really long shot to plan your life on it. Instead of being the biggest donor for the lottery by something you have really wanted for a while and save the money you were willing to give to the lottery.

Works Cited

Covert, Bryce. “How Lotteries Are Bad For Players, Winners, And States.” ThinkProgress, 20 May 2013, thinkprogress.org/how-lotteries-are-bad-for-players-winners-and-states-2148efa4f58b/.

Forster, Victoria. “Are You A High-Risk Investor? A Brain Scan May Soon Be Able To Tell.” Forbes, Forbes Magazine, 5 Apr. 2018, www.forbes.com/sites/victoriaforster/2018/04/05/are-you-a-high-risk-investor-companies-may-soon-be-able-to-scan-your-brain-to-find-out/#558db60a741c.

“How Much Money Do Americans Spend on Lottery Tickets?” U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, 29 Aug. 2019, www.bls.gov/opub/ted/2019/how-much-money-do-americans-spend-on-lottery-tickets.htm.

Mangels, John. “Gambling Addicts Arise from Mix of Flawed Thinking, Brain Chemistry and Habitual Behavior.” Cleveland, 15 May 2011, www.cleveland.com/metro/2011/05/gambling_addicts_arise_from_mi.html.

Nahman, Haley. “This Is Your Brain on a Lottery Ticket.” Man Repeller, 4 Jan. 2017, www.manrepeller.com/2017/01/lottery-psychology.html.

Piore, Adam. “Why We Keep Playing the Lottery - Issue 4: The Unlikely.” Nautilus, 1 Aug. 2013, nautil.us/issue/4/the-unlikely/why-we-keep-playing-the-lottery.

Rolison, et al. “Risk-Taking Differences Across the Adult Life Span: A Question of Age and

Domain.” OUP Academic, Oxford University Press, 22 Oct. 2013,

academic.oup.com/psychsocgerontology/article/69/6/870/545646.

“What Are Your Odds Of Winning the Lottery?” Wonderopolis,

www.wonderopolis.org/wonder/what-are-your-odds-of-winning-the-lottery.

Workman, Chip, and Cfp. “Should I Play The Lottery.” PlannerSearch, FPA,