Colby Pangerc

We’re reminded countless times about how important our education is, backed up with data sets that tell us the “consequences” of skimping out on our formative years. But with the drastic increase in college tuition, criticisms of standardized tests, and seemingly contradictory advice from countless public influencers telling us that college is not worth out time, the waters have become muddied and have made it difficult to make informed decisions about our futures.

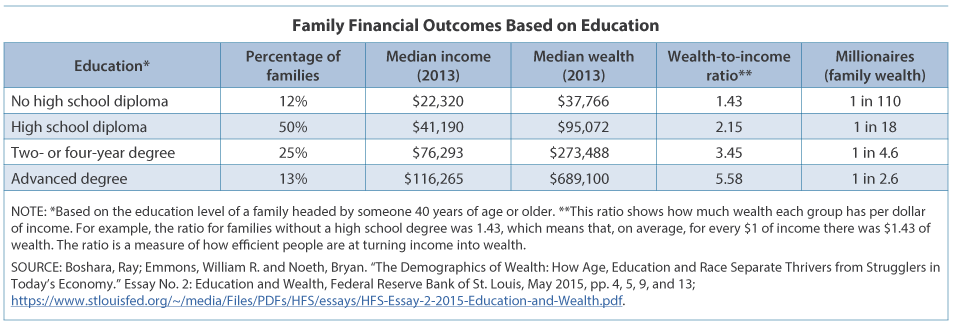

Perhaps education is best described as an investment, specifically in human capital. You are, after all, spending years of your life in school, even without advancing on to higher education, and assuming you attend college, the price of attendance can be its own beast. However, there are many sources that highlight the strong correlation between a higher education and income. Case in point,

“The higher income that results from a college degree is sometimes referred to as the ‘college wage premium.’ Research shows that this premium has grown over time. In addition, in general, the more skills people have, the more employable they are. As a result, workers with more education have a lower average unemployment rate than those with less education (

Federal Reserve Bank of St. Louis).”

The Scandinavian Journal of Economics

The Scandinavian Journal of Economics also wrote a paper concerning this question: How does education impact the economic growth of The United States? The paper explains that

“This increase in income is the key to understanding the link between investment in education and economic growth. People differ enormously in effectiveness on the job. Substituting more effective for less effective workers increases output per worker. More highly educated or better trained people are more productive than less educated or poorly trained people.”

The article concluded that,

“Our estimates of investment in education incorporate the impact of higher educational attainment on the value of nonmarket activities such as parenting or enjoyment of leisure, as well as the effect of increased education on earning power in the labor market. The time scale appropriate for measuring human capital formation is given by the lifespan of an educated individual.”

In other words, that means that the value of an investment in education are impactful over the full course of someone’s life. The benefits of a higher education also influence every aspect of one's life, not just their job or salary.

In addition to all of that, it’s not exactly a secret that Americans enjoy one of the highest living standards in the world. Of course, there are exceptions, but for the most part, Americans are enjoying more wealth than their foreign counterparts. According to the Foundation for Economic Education,

“A groundbreaking study has discovered that after accounting for all income, charity, and non-cash welfare benefits like subsidized housing and food stamps, the poorest 20 percent of Americans consume more goods and services than the national averages for all people in most affluent countries.”

And in the article’s unrelenting words, “if the US “[poorest]” were a nation, it would be one of the world’s richest (Foundation for Economic Education).”

That gives The U.S. the best of both worlds. A higher education is rewarded with a higher wage, on average; while, largely due to the success of the United States economy, there is a very large buffer between you and poverty. This makes pursuing higher education in The United States a very worthwhile investment because of the odds that your “investment” will pay for itself. However, you can also afford to take risks, invent, and explore new ideas, because you can be assured that failing is not a detrimental loss. Failing in The United States is a lot less dangerous than the same in Venezuela, Brazil, or one of the many developing African or Middle Eastern nations. You don’t want to end up broke in one of the Venezuelan favelas.

But what about the cost of college you might protest?

Well, there’s really no skirting around this one. Anyone that decides to pursue a college education will have to bite the bullet. There’s also no shortage of sources reminding us that a total of $1.53 trillion is owned in student debt, or that the average amount owed is $37,172 (

NitroCollege.com). Not all is lost though.

“Amid the alarming statistics, there is some good news as well. Higher education is a cornerstone of the American dream and, despite the rising cost, more than two-thirds of American high school students choose to go to college (

NitroCollege.com)”

A national poll conducted by Morning Consult also found “61% of adults said that, even based on their “current financial situation,” taking out student loans was worth attending college.”

Forbes also reported that “Generation-Z, which the poll identified as 18-21 years old, said loans were worth it by a margin of 79% to 19%. Even among Millennials, ages 22-37 and the generation with the most student debt, 56% said the loans were worth it.”

College may be an expensive investment, but many of the people that attend and graduate with a degree say that their investment was worth it in the end.

Obviously the pursuit of higher education can be a nuanced and complex topic and every case should be taken individually. College is most certainly not for everyone, and if your career of interest does not require a 4 year degree or greater, why bother with the extra hassle? However, if you’re on the fence, consider taking on the challenge. Many of the people who graduate don’t regret their decision, and correlation between a greater education and salary is extremely strong. An “investment” in education suggests that the outcome will outweigh the costs.

Works Cited

Agresti, James D. “The Poorest 20% of Americans Are Richer on Average Than Most European Nations: James D. Agresti.” FEE Freeman Article, Foundation for Economic Education, 30 Aug. 2019, fee.org/articles/the-poorest-20-of-americans-are-richer-than-most-nations-of-europe/.

B2B, Clodagh. “What's the Importance of Higher Education on the Economy?” Digital Marketing Institute, Digital Marketing Institute, 10 Dec. 2018, digitalmarketinginstitute.com/blog/what-is-the-importance-of-higher-education-on-the-economy.

Günel, Sinem. “The Power of Education and Why It Is More Important than Ever Before.” Medium, The Ascent, 19 Feb. 2019, medium.com/the-ascent/the-power-of-education-and-why-it-is-more-important-than-ever-before-c0653b03b005.

Newton, Derek. “Even Borrowers Agree, Student Debt Is Worth It.” Forbes, Forbes Magazine, 19 Apr. 2019, www.forbes.com/sites/dereknewton/2019/04/19/even-borrowers-agree-student-debt-is-worth-it/#184a895416aa.

Nitro College. “Average Student Loan Debt in the U.S. - 2019 Statistics.” Nitro, www.nitrocollege.com/research/average-student-loan-debt.

“The Schools Aren't Broken, They're Outdated.” Teachers College - Columbia University, www.tc.columbia.edu/articles/2000/september/the-schools-arent-broken-theyre-outdated/.

“Why Education Matters for Economic Development.” World Bank Blogs, blogs.worldbank.org/education/why-education-matters-economic-development.

Wolla, Scott A., and Jessica Sullivan. “Education, Income, and Wealth.” Economic Research - Federal Reserve Bank of St. Louis, research.stlouisfed.org/publications/page1-econ/2017/01/03/education-income-and-wealth/.

Jorgenson, Dale W., and Barbara M. Fraumeni. “Investment in Education and U.S. Economic Growth.” , vol. 94, 1992, pp. S51–S70. , www.jstor.org/stable/3440246.