The Nintendo Switch Shortage: How was it caused?

Written by: Nathan Monday

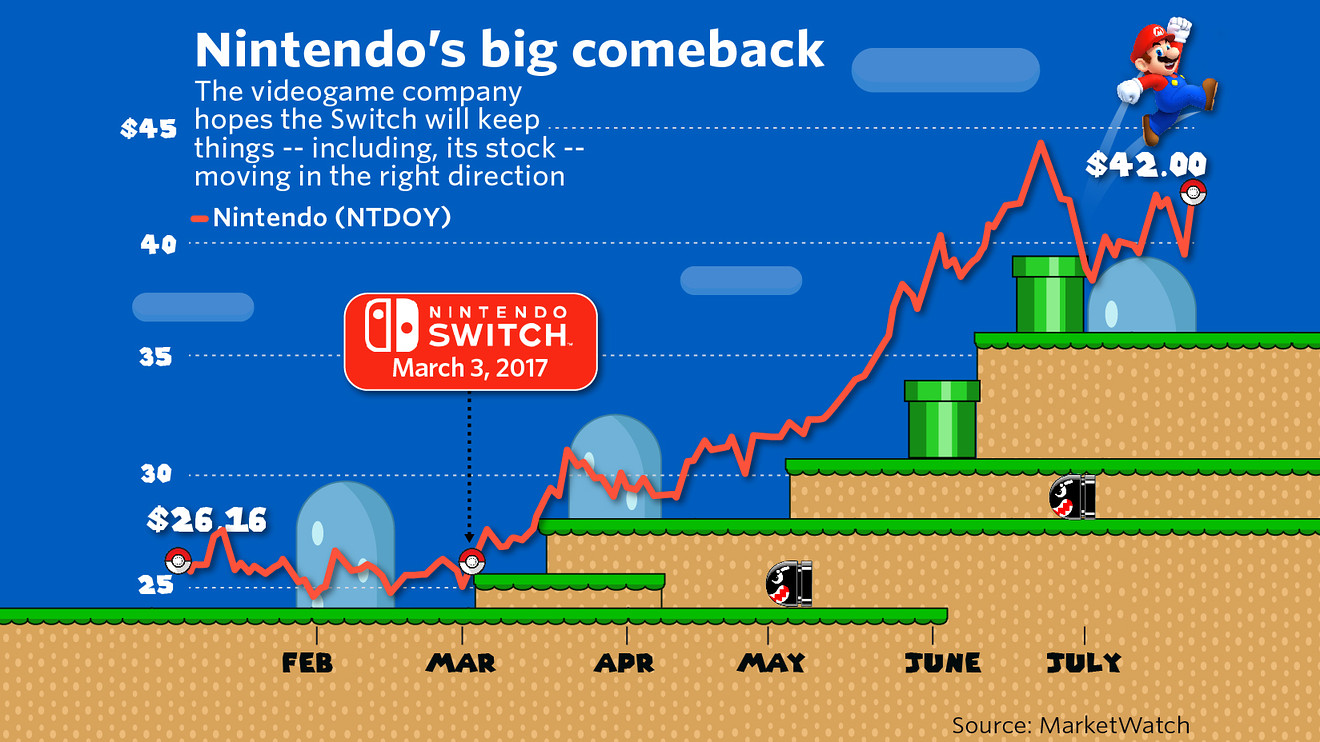

Nintendo has been a dominant force of nature in the gaming industry. While it has competition with other major gaming oligopolies like Sony and Microsoft, it was pretty dominant in 2020. While Sony came out with its Playstation 4 and Microsoft had its XBox One, Nintendo made a significant impact with its Nintendo Switch. The Switch had sold around 62 million units, with plenty of game options like Mario: Odyssey, Legend of Zelda: Breath of the Wild, Super Smash Bros. Ultimate, and Animal Crossings New Horizons, after its release in 2017, March 3rd. But while it was released in 2017, it was most important in 2020, eventually selling out. But how did the biggest gaming oligopoly end up selling out their biggest gaming console? Well, the pandemic definitely helped with the increase in demand for the Switch, leading to shortages, with the production unable to achieve such high demand.

Supply and demand can be found everywhere within economics, including the gaming industry. And there is plenty of supply and demand for the Nintendo Switch. During the beginning of the pandemic, there was a shortage of toilet paper that made news headlines. This was the result of various factors, like fear that the pandemic might require citizens to stay inside and worries that the current toilet paper supply might run out or people just stocking up on essential items. Whatever the motivation was, it was clear that the demand was becoming higher for toilet paper. Unfortunately, the supply for the amount demanded from all consumers becomes more difficult to achieve and equilibrium becomes impossible to reach. And the companies and manufacturers for this product are unable to increase production because it would be difficult for them to switch up and change their operations. As much as they may produce, they are unable to produce as much as they can to meet the demand for everyone and eventually have to deal with more demand and increasing order amounts. And with the pandemic, many workers end up being laid off from their job and having to quarantine, production may take a significant hit.

A similar thing that has happened with toilet paper has also happened with the Nintendo Switch. Currently, the Nintendo Switch has gone through a similar shortage and is facing difficulties with shipping across the world right now. Though before the pandemic hit the Switch was already in high demand, the stay at home and quarantining orders from the government has caused people to turn to entertainment to keep them busy. In January of this year, sales for the Nintendo Switch reached around 52 million, as said by an article by Forbes. But people staying at home has led to sales to begin to increase, with people having little to do at home. However, along with high demand comes stocks within the industry. Once natural consumers begin to increase, stock begins to run out quickly, as stated by Forbes, and with the Nintendo Switch, the stock began to run out fast, with people hearing about how it is going out of stock, causing more sales. With that, supply becomes more and more depleted and prices benign to rise. According to The Deal Experts, “If you absolutely need to buy a Nintendo Switch right now, you can still find Nintendo Switches for sale online, but with the situation being so dire, you will be paying exorbitant prices. As of today, the cheapest Nintendo Switch for sale on Amazon right now is more than $400, and the cheapest Lite is $230. Those won’t be able to be shipped for weeks. If you were to pay for either model to be delivered ASAP, you would have to pay approximately $480 or $299 respectively.” The price rising is so that it is possible for demand to possibly be depleted in order for the demand to eventually deplete, so manufacturing can continue so that they can eventually meet the demand for the Nintendo Switch. As supply begins to be depleted and as demand continues, the shortages that the Switch is facing will continue to happen, so it would be important for the company to try to earn profit and make sure it will be able to satisfy its customers by providing their consumers by increasing production. However, with the resource market, demand could begin increasing. As price increases for the product, resource demand will begin to increase as well. It is unclear whether this may be beneficial or not, but it could be possible this could help or damage the shortage of the Switch.

The shortage of The Nintendo Switch also has other factors it was affected by: manufacturing. According to both Forbes and Business Insider, while Nintendo is a Japan-based company, many of its manufacturing comes from China, and supply not being able to keep up with the increasing demand can be due to China. As said by Business Insider, “Supplies of the system were already hindered by the shutdown of manufacturing in China during February, when "there were no consoles produced," Niko Partners Senior Analyst Daniel Ahmad told Business Insider earlier this month. About 90% of Nintendo's Switch consoles made for the US come from China, he said.” Another quote from Forbes, apparently China manufacturing had to be shut down. Even as it is recovering, the demand for other products, not including the Switch, is dropping and could be detrimental to China’s status as a manufacturing juggernaut. What comes with the less production from China, comes less supply that can happen. With the supply decreasing, equilibrium becomes less of an attainable goal. And Nintendo depends heavily on China. It can’t just print out other copies of the Switch, as that is yet possible.

In order for the Switch to make sales, it must be sold to other markets, like stores including Target and Walmart. Products can also be sold online, which can create an easier way of purchasing a product. Unfortunately for the stores, the shortage of supply and the ever increasing demand can severely affect stocks, except for digital form, like Amazon. According to Market Watch, “In the U.S. too, scarcity has only made the Switch more sought after. Some fans have spent months trying to find a Switch, and sellers on Amazon.com, are getting $380 or more for a unit. Wal-Mart Stores Inc., Target Corp., and GameStop Corp., said they have struggled to meet demand both in stores and online.” With scarcity, the price begins to rise, which is also causing much of the stores to fail to make profit from the Switch. While Amazon is increasing sales, the stores have experienced the product being sold out, negatively affecting their Nintendo sales. The shortage may continue, which will only affect their stocks further into 2020, which can damage the economy, and even cause some shops to possibly shut down, if gone too extreme. Of course, these companies have other products from other oligopolies it can sell, so it isn’t likely that they’ll run out of stock soon. But with the Switch selling fast, it is important for Nintendo to possibly increase their manufacturing and production, if they are able to keep their steady increase in sales and help the other companies refresh their stock.

Other companies that deal with gaming consoles have also faced the same factors that the Switch has, including the Playstation 4 and the Xbobx One, mentioned in the beginning. Fortunately, the Nintendo Switch can get out of this shortage soon enough. The same Business Insider article claims that they have plans in order to produce around 22 million Switch devices by next year. There was no way that Nintendo could have ever predicted the pandemic increasing their demand and driving up their stocks, so it is unfortunate that a company had to deal with the unfortunate situation they were dealt. It would be interesting to see if anything similar happens in the future, with this pandemic raging on with now end in sight. In order for companies to keep up with the demand for their devices, it seems that there are new systems being developed, so it's possible for a new shortage to happen soon enough. If you were iIntendo, what would you have done in order to reach equilibrium, by either increasing supply or trying to decrease demand?

Works Cited

-, Chris S., et al. “The Nintendo Switch Is Sold out All over the Place, Making Prices More Expensive than Usual.” TheDealExperts, 5 Sept. 2020, www.thedealexperts.com/news/gaming-news/the-nintendo-switch-is-sold-out-all-over-the-place-making-prices-more-expensive-than-usual/.

Gilbert, Ben. “Nintendo Plans to Produce 22 Million Switch Devices to Address Supply Shortages.” Business Insider, Business Insider, 20 Apr. 2020, www.businessinsider.com/nintendo-switch-production-increasing-animal-crossing-2020-4.

Kain, Erik. “This Is Why It's Almost Impossible To Buy A Nintendo Switch Right Now.” Forbes, Forbes Magazine, 21 Apr. 2020, www.forbes.com/sites/erikkain/2020/04/21/why-its-even-harder-to-find-a-nintendo-switch-than-toilet-paper-right-now/#52fe48c24473.

Mochizuki, Takashi, and Sarah E. Needleman. “Nintendo's Switch: Plenty of Demand, but Short on Supply.” MarketWatch, MarketWatch, 27 Aug. 2017, www.marketwatch.com/story/nintendos-switch-plenty-of-demand-but-short-on-supply-2017-08-27.

Trumbore, Dave. “My Mushroom Kingdom for a Nintendo Switch: How the Console Supply Chain Broke Down.” Collider, 15 July 2020, collider.com/nintendo-switch-sold-out/.