Vegan Burgers?

Han Nguyen

Unless you have been living under a rock, you most likely have heard the rise of different diets. Such as the Carnivore diet, a diet where an individual strictly consumes meat and nothing else, hence the coined term “Carnivore” diet. Or maybe you’ve heard of the “Vegan Diet”?

A term that has been the butt of the joke for decades; Vegetarians are finally getting the acknowledgment they deserve. For years the media has been generalizing Vegans as hippies or lack for a better word, attention seekers. However with big nations and even the entire world, is dealing with the inevitable Climate Change Crisis, as scientists and world leaders are even encouraging individuals to partake or adjust to the Vegan Diet.

Scientist from Cleveland, Ohio, researched and questioned the theory that if an individual changes to a plant-based diet, would it decrease any major health issues? Thus their experiment on “the impact on cardiovascular risk in obese children with hypercholesterolemia and their parents” concurred. In short, the children had trouble with their high cholesterol levels and differences in heart palpitations. Which was diagnosed that these problems were inherited via biological parents. Something that is irreversible and cannot be changed, causing the scientist to seek out a different solution-- a change in the subjects diet. Resulting in the children to have a decrease in their cholesterol and CVD (Cardiovascular Disease) from just having a plant-based diet. Now you may be wondering “how does this relate to Economics?”, well let me explain.

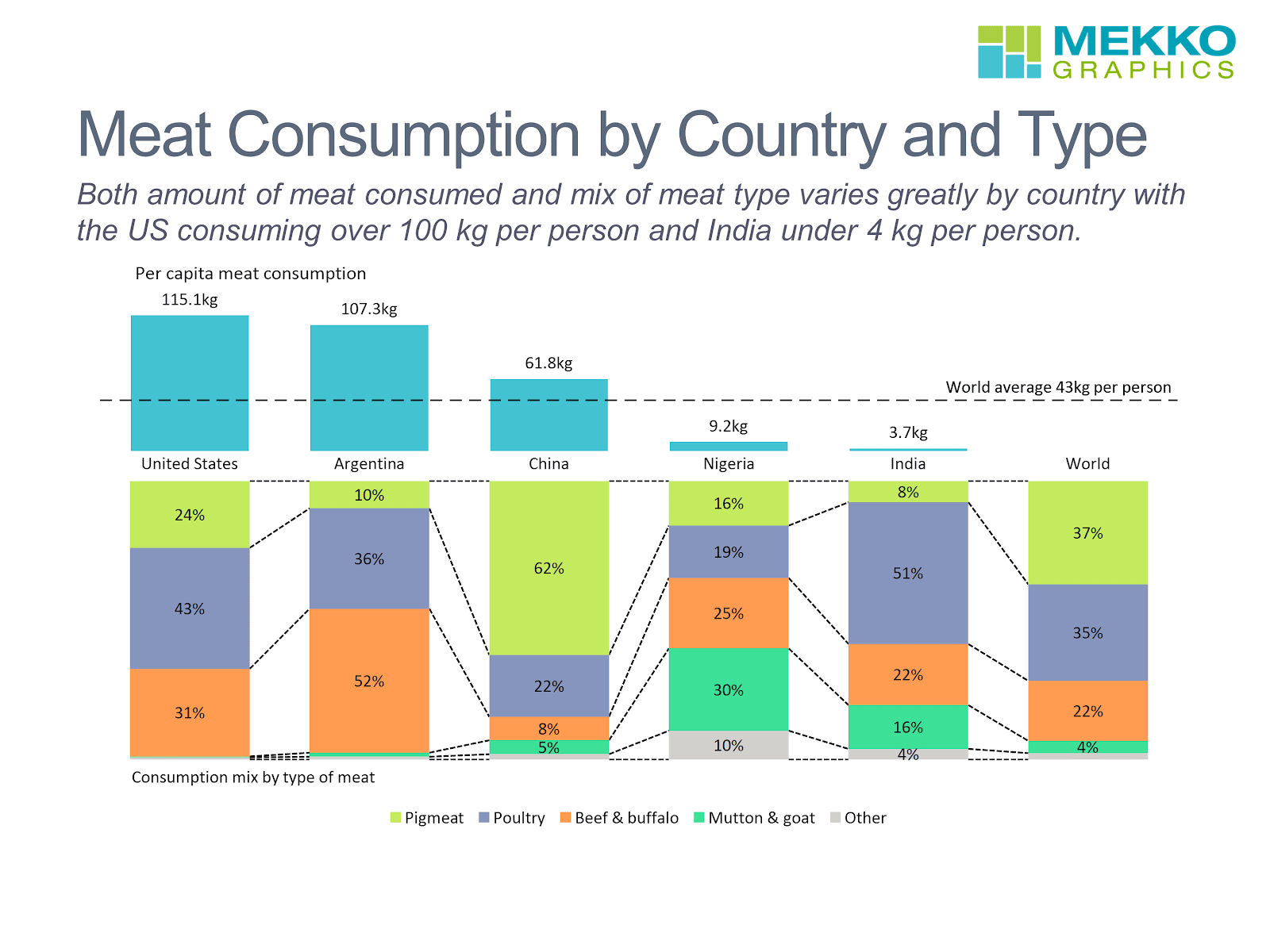

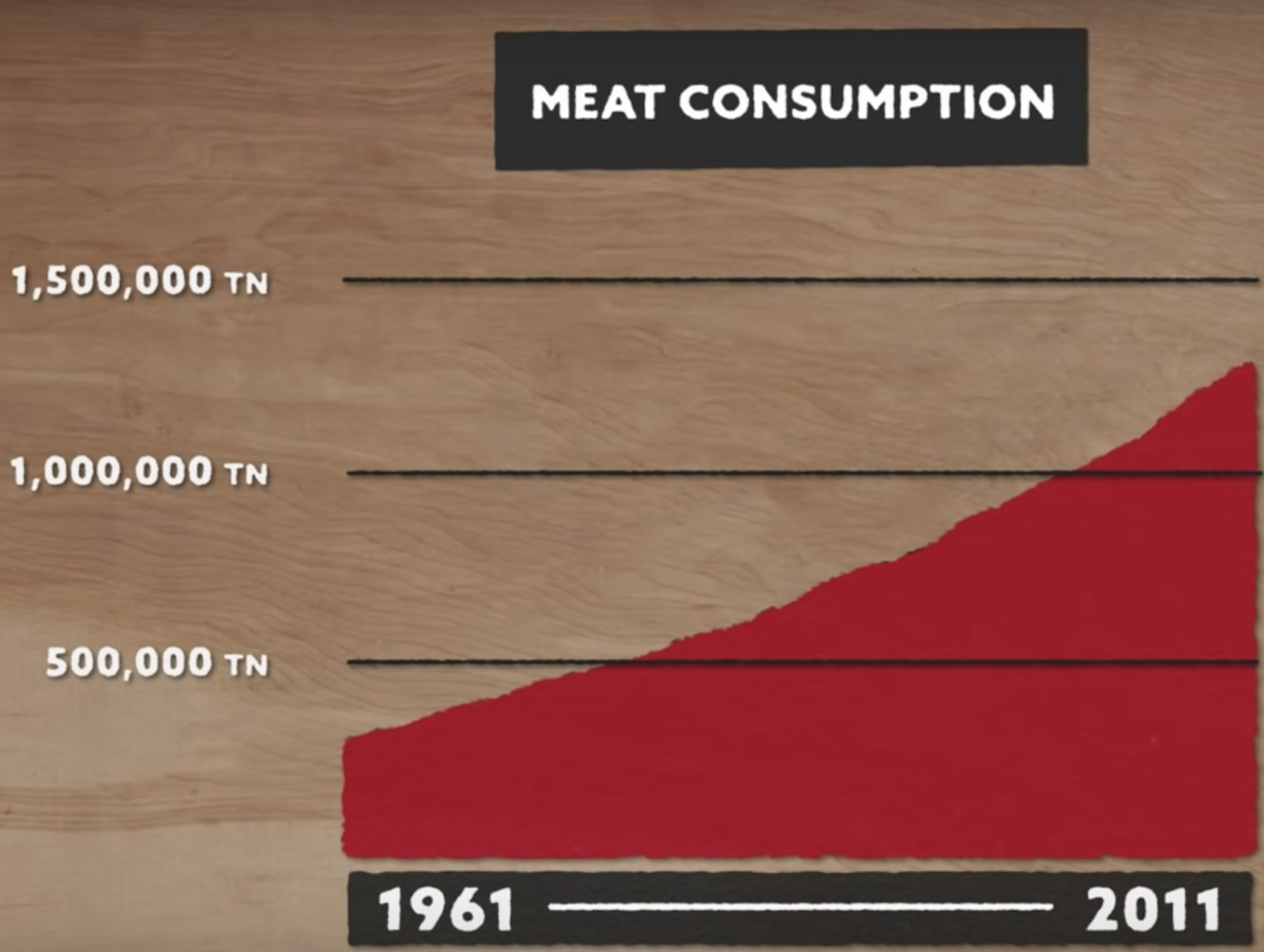

For years, people have snubbed the idea of changing their diet, or they simply do not care what they consume, I’m sure you have too because I have. Even after relentless efforts from health professionals encouraging a healthier eating habit, habits such as eating a plant-based diet or even a vegan diet. Even with that-- still nothing. The answer is simple, people do not care. However, the one thing a majority of Americans care about is -- money. Although money is a contributing factor in the climate change crisis is the mass production of oil, mass production of automobiles, mass production of plastics and especially mass production of meat packaging (

NRDC.ORG).

According to

theconversation.com, farming livestock, including cattle, chickens, pigs, goats, etc. Emits around 6 billion tonnes of greenhouse gasses each year. Contributing about 20% of global emissions, this is equivalent to all the planes, cars, boats and trains exerting CO2 in America annually combined. Although there is a contradicting argument on the fact that cutting the meat industry cold would have detrimental effects on any economy-- especially America. It may be hard to believe that in the 21st century, but there are still farmers working and not living in the city with blue-collar jobs. The meat industry is responsible for 5.4 million jobs and a whopping $257 billion in wages alone. I counter this argument that the job losses would be prevalent but not as significant as most would think. The transition to meat to plants would increase jobs, in terms of developing and transitioning old land that produced livestock to crops. While the meat industry would take a dent in consumers buying meat, a plus side is that their excess waste problem would ultimately be eliminated. As in 2018, Americans wasted $160 billion in food, nearly 30-40% of food supply, unsurprisingly a majority of it was meat (

usda.gov). Making the transition between meat and plants worth is from an environmental perspective and even economical.

To further solidify my counter-argument, it takes more money and resources to produce and keep livestock than it is for crops. More specifically, 41% of Americas’ land is used to feed livestock. This process includes land to raise and hold livestock, land to graze, land to feed and land to distribute (treehugger.com). While theoretically, it would only take about less than half of the 41% of the land; if America transitions to a more dominant plant-based diet. Not only does livestock take up an enormous amount of land but it also uses a significant amount of water.

A popular comparison for an alternative way to use the economies resource (PPC), is that, it takes about an entire swimming pool of water just to produce 24 hamburgers, meanwhile, a pool of water would roughly make 75 loaves of whole-grain bread and thirty jars of peanut butter. (

LA TIMES). Both equal in regards to protein and calories, as a single hamburger patty and a peanut butter sandwich, have 20 grams of protein and 280 calories. If eaten twice a day, the patty would last the individual a little over a week while the peanut butter sandwich would last the individual a little over a year. With such a concept at its basics, imagine how much time, energy, land, water, and money would be saved if an economy transformed its effort into something more economically suitable to solve a multitude of problems it is currently facing. Concluding that this alternative solution provides efficiency, for seemingly limited resources as in the future food goods will be scarce.

These few problems that the meat industry has risen by itself are only starting within America. According to Bill Gates, this will eventually be a problem for all social classes and will inevitably affect the economy. As social polarization becomes more prevalent when nations become more advanced, the social gaps between the underclass and middle class would be wider and wider. As the upper class and even the 1% seems unreachable. Not only is this in itself a problem, but it correlates to nutrition as the richer people get, the more they’re enticed to consume meat. This demand will only continue to grow, the world has already seen this first hand, as this was the main cause of the Amazon forest fire. As farmers residing in the Amazon were forced to burn the forest to allow more land for livestock to graze and breed due to the high demand from meat consumers (

RainforestAlliance.Org).

Lastly, the dilemma most Americans face is the current issue of prices for plant-based products. Currently as of February 22nd, 2020 at Pick n’ Save, a vegan patty is $3.99 (before taxes) for only 2 counts. While a 4 count beef patty is $5.99. Making the beef patty a cheaper alternative, even though the production of the beef patty used double the resources in comparison to the vegan patty.

This is due to supply and demand as on average Americans spend roughly almost $1,000 annually on meat alone in 2018 (

rfdtv.com). Making the consumer surplus to have a meat being the norm to pay, even if in hindsight it is cost-effective. To solve this ironic paradox from an economic perspective starts from the individual American. It is simple as just not eating meat, although this does not mean to cut meat cold, adjusting little by little or how much you want. You could participate on meatless Mondays or just limiting the amount of meat consumption. This may sound too good to be true for some because it seems too simple. This is basic economics, for example, let's say an individual decides to participate on meatless Mondays because many other individuals are already participating on meatless Mondays. Making businesses such as McDonalds not having to produce meat, particularly on Mondays since no consumers are consuming their products with meat on Mondays. This will inevitably cause a chain reaction, as farmers and the meat industry cut back on their products because there is no demand-- because of meatless Monday. This little action can save and reverse the effect of the climate change crisis, leading a healthier lifestyle, decreasing waste and greenhouse gases and preventing a future economic catastrophe. So ask yourself, would you eat a vegan burger?

Works Cited

“About Us.” NRDC, 3 Dec. 2019, www.nrdc.org/about?gclid=Cj0KCQiAv8PyBRDMARIsAFo4wK0Qyfm0lGMBCCrKdr-K5zpRxY6Vzbaspel8pnrgutauBSUoXp_pERoaAuRREALw_wcB.

“Food Waste FAQs.” USDA, www.usda.gov/foodwaste/faqs.

Grover, Sami. “41% Of Land in Contiguous US Is Used to Feed Livestock.” TreeHugger, Treehugger, 11 Oct. 2018, www.treehugger.com/sustainable-agriculture/41-land-contiguous-us-used-feed-livestock.html.

Herrero, Mario. “To Reduce Greenhouse Gases from Cows and Sheep, We Need to Look at the Big Picture.” The Conversation, 8 Jan. 2020, theconversation.com/to-reduce-greenhouse-gases-from-cows-and-sheep-we-need-to-look-at-the-big-picture-56509.

Macknin, Michael, et al. “Plant-Based, No-Added-Fat or American Heart Association Diets: Impact on Cardiovascular Risk in Obese Children with Hypercholesterolemia and Their Parents.” The Journal of Pediatrics, U.S. National Library of Medicine, Apr. 2015, www.ncbi.nlm.nih.gov/pubmed/25684089.

“The Rainforest Alliance's Response to the Fires in the Amazon Rainforest.” Rainforest Alliance, Rainforest Alliance, 22 Aug. 2019, www.rainforest-alliance.org/articles/rainforest-alliance-response-to-fires-in-amazon-rainforest.

“To Make a Burger, First You Need 660 Gallons of Water ...” Los Angeles Times, Los Angeles Times, 27 Jan. 2014, www.latimes.com/food/dailydish/la-dd-gallons-of-water-to-make-a-burger-20140124-story.html.