Becca Rentz

We’ve heard enough about COVID-19, the presidential race, and student loans (seriously y’all). So, allow me to take you to a happier place: one of windmills, bicycles, and, according to Pitch Perfect 2, the Acapella World Finals. You (maybe incorrectly) guessed it: Denmark.

If you know anything about world economies, when you hear the word socialism, you probably think of Scandinavia. You know, northern Europe where all the vikings were. For the sake of brevity, I’m only going to talk about Denmark, since it’s without a doubt the coolest country out of the three.

Are taxes really ridiculously high there? Does the government play too big of a role? Is their healthcare system a mess? Are there still vikings?

But first, here’s a video to introduce you to Denmark's economy. Or, if you think the first video will bore you out of your skull, here’s one just showing how pretty Denmark is. Or here’s another just talking about vikings. We both know you have a lot of time on your hands right now.

Here are some quick stats...

- GDP: $326 billion in 2018

- GDP per capita: $56,300

- Inflation: 1.1%

- Public debt: 35% of GDP

- For context, the US’s debt-to-GDP ratio in 2017 was 105.4%.

- #7 on Forbes’s list of Best Countries for Business (US ranks #17)

- Unemployment: 5.7%

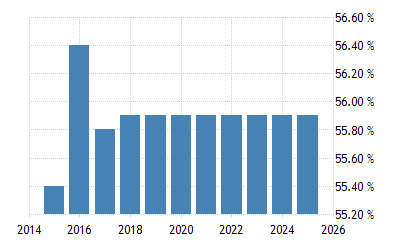

Just based on those statistics alone, Denmark’s economy seems to be a pretty solid one. But what about taxes? Their highest tier of personal income tax rates in 2018 was 55.8%, according to Trading Economics. Their corporate tax rate was 22%. Moreso, Denmark’s tax system is a progressive one: if you make more, your tax rate is higher. To most of us, having grown up in the United States where the vast majority of the population vehemently despises tax raises, this seems like pure insanity. However, most Danes don’t see it that way: they see taxes as a trade off between income and quality of life. According to U.S. News, “The reason behind the high level of support for the welfare state in Denmark is the awareness of the fact that the welfare model turns our collective wealth into well-being. We are not paying taxes. We are investing in our society. We are purchasing quality of life.”

Just based on those statistics alone, Denmark’s economy seems to be a pretty solid one. But what about taxes? Their highest tier of personal income tax rates in 2018 was 55.8%, according to Trading Economics. Their corporate tax rate was 22%. Moreso, Denmark’s tax system is a progressive one: if you make more, your tax rate is higher. To most of us, having grown up in the United States where the vast majority of the population vehemently despises tax raises, this seems like pure insanity. However, most Danes don’t see it that way: they see taxes as a trade off between income and quality of life. According to U.S. News, “The reason behind the high level of support for the welfare state in Denmark is the awareness of the fact that the welfare model turns our collective wealth into well-being. We are not paying taxes. We are investing in our society. We are purchasing quality of life.”Quality of life isn’t fully captured in statistics, so here’s some information about Denmark that’s less directly related to economics (yes, Mrs. Straub, I understand that everything is related to econ, just let me have this). Education isn’t just affordable, it’s free, even medical school! On top of that, students receive roughly $900/month from the government to help subsidize their education (to cover things besides tuition, like rent, books, etc). Denmark has some of the most generous policies in the world when it comes to parental leave: up to 52 weeks over the course of a child’s first nine years of life, the bulk of which is given right after they’re born. Workers also receive five weeks of vacation time and 11 paid holidays (compare that to the US...). They also receive what is commonly referred to as “free quality healthcare.” What does that mean?

There are few issues in the US as controversial as healthcare. Even people of the same political party often have difficulty agreeing. Meanwhile in Denmark... according to The Commonwealth Fund, “Publicly financed health care covers all primary, specialist, hospital, and preventive care, as well as mental health and long-term care services. Dental services are fully covered for children under age 18. Outpatient prescription drugs, adult dental care, physiotherapy, and optometry services are subsidized.” Out of pocket healthcare spending per capita in 2018 was $671. Meanwhile, the US’s was $1,125 in 2017. As for satisfaction, Denmark seems to be succeeding there as well. “The Danish health care system is popular, with patient satisfaction much higher than in our country. In Denmark, every citizen can choose a doctor in their area. Prescription drugs are inexpensive and free for those under 18 years of age. Interestingly, despite their universal coverage, the Danish health care system is far more cost-effective than ours. They spend about 11 percent of their GDP on health care. We spend almost 18 percent.” (Huffpost)

Overall, Forbes sums it up quite well, “Danes enjoy a high standard of living, and the Danish economy is characterized by extensive government welfare measures and an equitable distribution of income.” Equal opportunity is prioritized, exemplified by their parental leave and education policies. As Huffpost remarked, “While it is difficult to become very rich in Denmark, no one is allowed to be poor.”

But before you start packing your bags to move to the haven Denmark seems to be (once travel bans are lifted, of course), keep in mind just how different the United States and Denmark are, in size, demographics, and history. “As Ambassador Taksoe-Jensen explained, the Danish social model did not develop overnight. It has evolved over many decades and, in general, has the political support of all parties across the political spectrum. One of the reasons for that may be that the Danes are, politically and economically, a very engaged and informed people. In their last election, which lasted all of three weeks and had no TV ads, 89 percent of Danes voted.” (Huffpost) Denmark is in many ways the polar opposite of the United States.

Don’t attack me in the comments saying socialism is wrong and Denmark has it all backwards, but there’s certainly a lot about their system that makes for good discussion.

Works Cited

“Denmark Personal Income Tax Rate.” Trading Economics, 2018, tradingeconomics.com/denmark/personal-income-tax-rate.“Denmark.” Forbes, Forbes Magazine, Dec. 2018, www.forbes.com/places/denmark/.

“Out-of-Pocket Spending.” Peterson-Kaiser Health System Tracker, Peterson Center on Healthcare, www.healthsystemtracker.org/indicator/access-affordability/out-of-pocket-spending/.

Sanders, Bernie. “What Can We Learn From Denmark?” HuffPost, Verizon Media, 26 July 2013, www.huffpost.com/entry/what-can-we-learn-from-de_b_3339736?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAJhGrXDPb4LDNraEcOriI0ECl3ajr6j3oQusEKPEY7g7EMTMu5Il3yjZnkERUFmCYSniJSN4cFyKUyO8HNjvqx8gRUC2SRwaCOx9h_U_5_DG_Hr04iHheMmujXDO7AxuLeAwKrDlrnAlleCsM_ywczWX69WKavJ_dku9a_TNACFP.

Wiking, Meik. “Why Danes Happily Pay High Rates of Taxes.” U.S. News, U.S. News & World Report, 20 Jan. 2016, www.usnews.com/news/best-countries/articles/2016-01-20/why-danes-happily-pay-high-rates-of-taxes.