Written by: Sam R.

These funds are all in a portfolio and are controlled by a portfolio manager. That is the basis of what a mutual fund is, but there are more than one kind of mutual fund. There are open ended mutual funds and closed end mutual funds. These funds also tie into the net asset value(NAV.) It represents the “net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.” Said Investopidia.

Closed-ended mutual funds depend on the supply and demand of companies and you have a set number of shares that you can have. You have a better return rate and better income streams. This might seem good, but you have a set number of shares people can buy and the NAV “May get heavily discounted,” said investopedia. Open-ended mutual funds are the most common mutual fund out there, they don’t have a set number of shares, and it will give new shares to investors depending on the NAV of the fund.

There are loads to a mutual fund as well. Loads are like a sales tax but the investors pay for it and the NAV as well. But there are some mutual funds that don’t have loads in them, they are called no load. The investors don’t have to pay for a sales commission, only the NAV.

Thoughts are the types of mutual funds and how loads are tied into them. There are also types of open-ended funds and closed-ended. Funds. Thoughts funds have to do with the way they operate. There are large cap funds and small caps. Large cap funds only invest in large stocks that are not likely to go out of business but won’t make you as much money. Small cap funds only target the small business, their stocks are cheap but the risk factor is much greater than Large cap because people don’t know if the business will go under. Small caps also invest in more small businesses. Large cap investors invest in 50-55 large companies and small cap invest in 60-65 companies.

There are fees as well, Loads, NAV and paying the portfolio manager. They both depend on how much money you make but the portfolio manager has a percentage on how much he gets from your mutual fund.

Mutual funds are needed because some people don’t have time to do an index fund so they go to a mutual fund. Might be more expansive but they don’t have to do it. Before going into college, you should have a mutual fund because you will have more money when you are in your 50s and 60s but it is a good way in starting to invest with you money.

Works Cited

Chen, James. "Closed-End Fund." Edited by Gordon Scott. Investopidia, Dotdash, 9 Mar. 2020, www.investopedia.com/terms/c/closed-endinvestment.asp#:~:text=Closed%2Dend%20funds%20often%20offer,values%20of%20its%20portfolio's%20holdings. Accessed 20 Apr. 2021.

---. "Net Asset Value." Edited by Thomas Brock. Investopidia, Dotdash, 19 Oct. 2020, www.investopedia.com/terms/n/nav.asp. Accessed 20 Apr. 2021.

Dana Investment Advisors. "Dana Funds." Dana Funds, Dana Investment Advisors, 2021, www.danafunds.com/. Accessed 20 Apr. 2021.

Fidelity. "What Are Mutual Funds." Fidelity, Fidelity Investment, www.fidelity.com/learning-center/investment-products/mutual-funds/what-are-mutual-funds#:~:text=Mutual%20funds%20are%20investment%20strategies,referred%20to%20as%20a%20portfolio.

Kennon, Joshua. "The Basics of Mutual Funds." The Balance, Dotdash, 3 Feb. 2020, www.thebalance.com/mutual-funds-101-356319. Accessed 19 Apr. 2021.

:max_bytes(150000):strip_icc()/mutual-funds-101-356319-v3-5b74a06bc9e77c0025fabf28.png)

I really liked your post. The visuals that you gave were very informative. How would you compare a mutual fund to stocks?

ReplyDeleteI really like that you explained what mutial funds are and how they work. it was alwaysa a topic i wanted to learn about

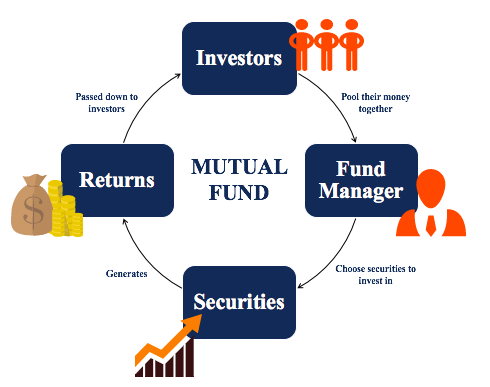

ReplyDeleteI did not know there were multiple types of mutual funds nor the purposes of either one. You said the open mutual funds were the most popular with a load but the closed ones don't have a load, would you recommend the open or closed one? Each are similar but very different in who pays what and shared price. The diagrams you used were very helpful in seeing the bigger picture of these funds, I think it would also be beneficial to include a picture/diagram of examples of each fund, if that makes sense. What would an open mutual fund look like after a while and vise versa for the closed mutual fund. Overall, this was interesting to read and I felt I learned more about what I should invest in while I'm young in order to have more money for when i'm older.

ReplyDeleteI did not know there were multiple types of mutual funds nor the purposes of either one. You said the open mutual funds were the most popular with a load but the closed ones don't have a load, would you recommend the open or closed one? Each are similar but very different in who pays what and shared price. The diagrams you used were very helpful in seeing the bigger picture of these funds, I think it would also be beneficial to include a picture/diagram of examples of each fund, if that makes sense. What would an open mutual fund look like after a while and vise versa for the closed mutual fund. Overall, this was interesting to read and I felt I learned more about what I should invest in while I'm young in order to have more money for when i'm older.

ReplyDeleteI thought that this topic was very interesting and applied to the things we are learning about in class right now. I didn’t know that there were different types of mutual funds and the purposes of each one. I like your pictures. They gave me a better understanding of everything and I think enhanced ur piece. What type of mutual fund would you prefer?

ReplyDeleteI didn't know there were different types of mutual funds or that they had sales commission. Based off of the diagram I saw,the closed mutual fund makes the most sense for me as there is no commission sales, and even though there's a limit to the # of investments, as someone who won't be very hands on that doesn't bother me so much. Which fits for you best?

ReplyDeleteI've had a hard time understanding what put Mutual funds apart from other investment opportunities so far, but I found this post really helpful in finally understanding. The pictures especially helped me to follow along with what the post was saying, and I now feel like I have a basic grasp of what a mutual fund is. You say mutual funds are a good investment strategy to start with, but why is that? Would you say that's because mutual funds invest in a large amount of companies/businesses, and so if one fails the others will catch the fall like a cushion? I hope to find out more about this in the future. Overall, really great job!

ReplyDeleteI think the visuals were really helpful in understanding your post. I also learned that there were multiple types of mutual funds.

ReplyDeleteI loved your blog post, Sam! It was very clear and easy to read and the visuals added a lot to the article. I didn’t know there were multiple types of mutual funds or what the different purposes were, so I found this super informative and insightful. It is the perfect intro to mutual funds so that I can do some more research on my own. Great work!

ReplyDeleteI didn’t have much knowledge about mutual funds, so this was a really interesting read. I also thought that your visuals were really helpful to understand the concepts being brought about, as there were quite a few. This article showed me just how important picking a good mutual fund, with the best finance plan, really is and I will make sure to remember this for the future. Nice Job!

ReplyDeleteI've personally invested in mutual funds and have had someone pick out each fund in a package for me. However, when you get your return you have to pay the advisor who put the fund together with a certain percentage. Another great option is to invest in index funds. Index funds are like mutual funds but an advisor isn't picking funds, a computed system is. Index funds do not have a percentage you need to pay at the end of your return and all the money you make you get to keep. Your article was very informative and great for someone interested in getting a mutual fund and how they are managed.

ReplyDeleteWow, I just learned so much about mutual funds! They seem very profitable but kinda risky because, anytime that you have to rely on someone else for your success does not end up so good. But If you can find a group that you can trust this seems like an awesome idea. You also had some brilliant visuals to go along with your post and those really were the cherry on top. Thanks for the great post!.

ReplyDeleteI thought that this topic was very interesting and applied to the things we are learning about in class right now. I didn’t know that there were different types of mutual funds and the purposes of each one. I like your pictures. They gave me a better understanding of everything and I think enhanced ur piece. What type of mutual fund would you prefer????

ReplyDelete