Are Drug Companies Exploiting the Elasticity of Specialty Drugs?

Written by: Kirsten Cutler

Modern day life provides a plethora of trials, challenges, and life-threatening experiences - one of the most prevalent being terminal and chronic illnesses. It is estimated that 7 out of 10 Americans die from chronic disease (Dartmouth Atlas of HealthCare), and often one of the only solutions to cure and/or treat these illnesses is through specialty drugs. The National Association of Specialty Pharmacy explains that “Specialty drugs are more complex than most prescription medications and are used to treat patients with serious and often life threatening conditions including cancer, hepatitis C, rheumatoid arthritis, HIV/AIDS, multiple sclerosis, cystic fibrosis, organ transplantation, human growth hormone deficiencies, hemophilia and other bleeding disorders.” Unfortunately, these life-saving drugs are typically way too expensive for a normal salary, and even medical insurance has limited coverage. Despite most people’s inability to reasonably afford these drugs, the demand remains high because of their life-preserving nature, and drug companies use this knowledge to charge extreme prices for a bigger pay day.

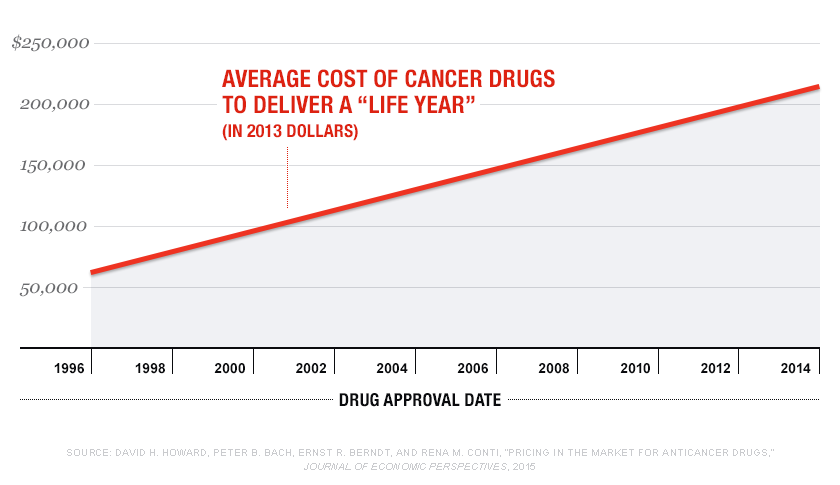

According to the US National Library of Medicine and National Institutes of Health, the spending on specialty drugs is rapidly growing, despite their high costs being intensely scrutinized by lawmakers, patient activists, and the popular press. In 2014, spending on specialty drugs grew by 30% (representing 32% of total drug spending in the U.S.) while traditional drug spending increased by only 6%. Despite the steep incline in prices, it is proven over and over again that demand for specialty medications will remain consistent (and sometimes even increase). Why is this? Specialty drugs are a life-saving necessity to those who need them. They are, in economic terms, relatively inelastic.

Price elasticity of demand is defined as “The ratio of the percent change in the quantity demanded to the percent change in the price as we move along the demand curve” (Krugman’s Economics second edition). In layman’s terms: elasticity is dependent on how much the demand for a good/service changes when the price of that good/service increases or decreases. If a change in price results in a sharp increase or decrease in demand then the product is elastic. If the demand remains consistent despite any changes in price, then it is inelastic. If a product was perfectly inelastic then the demand for that product would never change, regardless of any change in price.

Are specialty drugs perfectly inelastic? Not quite, but any change in demand due to price is typically quite minimal - at least in the US. Other countries, especially third world countries, are not as financially fortunate, and therefore, are not always able to afford specialty drugs. In these places the drugs are far more elastic. One specific example of this elasticity is the HIV/AIDS epidemic in Africa. According to the Health Affair journal, “At the end of 2000, 25.3 million persons were infected in sub-Saharan Africa, with 3.8 million new infections in 2000.” These skyrocketing numbers could be largely attributed to the lack of affordability of a drug that is widely available in western nations. Finally in 2017, after a new pricing deal was struck between the UN, African nation governments such as South Africa and Kenya, the pharmaceutical industry, and the US President’s Emergency Plan for Aids Relief (PEPFAR), the price of the HIV/AIDS treatment drug was lowered from $1000 to $75 a year in over 90 low to middle income countries. This major change in price indicates that the drug is elastic in these countries, and in order to increase demand there had to be a decrease in price. Comparatively, the cost of the same specialty drug in the US is $39,000 a year. This extreme price offsets the high cost of producing the drug, while also allowing the drug companies to make a profit. The higher average incomes in the US - as well as aid for those with health insurance - allows people to afford the $39,000, and it is why the cost is so much more inelastic compared to lower income countries. People can pay for the treatment, and so they will, which is the perfect opportunity for drug companies to raise prices unnecessarily in order to bring in a larger total revenue. When this happens it is up to the government to step in and place price ceilings on the drugs - just as they did with the HIV/AIDS treatment in Africa - so that a monetary value cannot be placed above the worth of human lives.

These high costs for treatments can become major financial burdens on individuals and families, especially because often a disease, such as HIV/AIDS or cancer, can impair people’s ability to work normal hours, or at all. Determining what is a fair price for a drug is a controversial topic and the responses vary depending on what role people play in the drug producing or consuming process. Currently, different patients pay different prices for specialty drugs depending on the specifics of their health insurance plans - or whether they have one at all. Even those who have health insurance often max out their plans when on specialty drugs, so the residual thousands of dollars is forced to be taken out of pocket. Drug manufacturers argue their high prices by explaining the high costs of researching and developing new drugs. It can take years to find potential test candidates and perform intricate tests that are highly expensive. However, there is much speculation by individuals that drug companies and intermediaries in the supply chain are exploiting the inelasticity of the drugs, as well as the confusing complexity of the system by charging high prices for drugs without justification.

One specific example of this exploitation was cited in a journal published by the US National Library of Medicine and National Institutes of Health. They discussed the case of the leukemia drug imatinib (Gleevec). The drug was released into the US in 2001 at the initial price of $4,540 per month of treatment. There was a very positive response to the drug and its effects, and by 2016 it cost $8,500 per month in the United States, but cost $4,500 and $3,300 per month in Germany and France, respectively. This increase in price occurred despite two major factors that would usually bring the price down. “First, because leukemia patients are living longer due to the drug's effectiveness and because new indications for the drug have been approved, the population treated with the drug has expanded, which has increased sales volume of the drug. Second, other drugs that target the same abnormal protein have entered the market. For most types of non-medical products, such a combination would result in more options and lower costs and prices.” Most of the other cancer drugs released into the market are not as effective as Gleevec in extending the lives of cancer patients, yet have similarly high prices, so with no competition the drug company was able to steadily increase their price with no relevant fluctuation in demand. Drug companies, such as this one, should be regulated so that their prices cannot majorly increase after the initial research costs are eliminated and the drug is put on the market. Extreme changes in price, even if they are gradual, are unfair to the consumers and take advantage of the inelasticity of the drugs - creating an unequal market. The government can protect the rights and lives of US citizens by monitoring the prices of specialty drugs, and placing price limits when necessary for the greater good.

Works Cited

Blue Cross Blue Shield Blue Care Network, of Michagen. “What Do I Need to Know about Specialty Drugs?” What Are Specialty Drugs? | Pharmacy, 2020, www.bcbsm.com/index/health-insurance-help/faqs/plan-types/pharmacy/what-are-specialty-drugs.html.

Dartmouth, Atlas Project. “End of Life Care.” Dartmouth Atlas of Health Care, 18 Aug. 2020, www.dartmouthatlas.org/interactive-apps/end-of-life-care/.

Goldman, Dana P, et al. “The Value of Specialty Oncology Drugs.” Health Services Research, Blackwell Science Inc, Feb. 2010, www.ncbi.nlm.nih.gov/pmc/articles/PMC2813440/.

Gow, Jeff. “The HIV/AIDS Epidemic In Africa: Implications For U.S. Policy.” The Independent, Independent Digital News and Media, 22 Sept. 2017, www.independent.co.uk/news/world/africa-hiv-aids-drugs-treatment-deal-under-threat-us-budget-cuts-a7960391.html.

Jung, Jeah Kyoungrae, et al. “The Price Elasticity of Specialty Drug Use: Evidence from Cancer Patients in Medicare Part D.” Forum for Health Economics & Policy, U.S. National Library of Medicine, Dec. 2017, www.ncbi.nlm.nih.gov/pmc/articles/PMC5877476/.

National Association of Specialty Pharmacy. “NASP Definitions of Specialty Pharmacy and Specialty Medications.” NASP, 24 Feb. 2016, naspnet.org/wp-content/uploads/2017/02/NASP-Defintions-final-2.16.pdf.

Rosenberg, Tina. “H.I.V. Drugs Cost $75 in Africa, $39,000 in the U.S. Does It Matter?” The New York Times, The New York Times, 18 Sept. 2018, www.nytimes.com/2018/09/18/opinion/pricing-hiv-drugs-america.html.

Sciences, National Academies of, et al. “The Affordability Conundrum.” Making Medicines Affordable: A National Imperative., U.S. National Library of Medicine, 30 Nov. 2017, www.ncbi.nlm.nih.gov/books/NBK493099/.