Caitlin Bulacan

Economics

10.29.2019

Pumpkin Spice Lattes

As we transfer into the winter season, new data on the beloved pumpkin spice latte is rolling in from this 2019 fall season. Starbucks iconic seasonal drink was released back in 2003, which gained popularity quickly because this latte provided a new type of drink into the coffee realm. The ingredients that play a role within this latte are real pumpkin spices, cinnamon, clove, nutmeg, milk, and whipped crew to top it off. A recent Forbes article claims that over 424 million cups has been sold since the release back in 2003, and the direct effect is revenues and profits for Starbucks. As well, one analyst estimates sales of the pumpkin spice latte brought in more than $100 million in 2015 alone. With data showing how the demand for coffee will increase more than 25% between 2016 and 2020, this will shift the demand curve to the right because there will be more consumers buying this popular drink.

Because this seasonal drink is only offered for a couple months, pumpkin spice latte lovers have to face the rest of the year without the ability to consume this drink. But once the PSL hits the market the following year, consumers are willing to pay more money for this product because there is a scarce amount of pumpkin lattes. Which this allows Starbucks to make a larger profit, due to this product bring of a monopoly - a company with no competition. Although competing brands have tried to recreate this latte, no one has come close to bring in the revenues Starbucks has made off this product. For the typical sized pumpkin spiced lattes, customers pay a total of $7.81- $8.30, but those who purchase non-holiday drinks only have to pay part of that price.

In addition to this popular holiday drink, Starbucks also has a twitter page for this infamous drink. This drink has gained popularity nationwide, and Starbucks is hoping to add more pumpkin based drinks to the menu next year. Which will only provide a bigger revenue for Starbucks. According to Nielsen, annual sales of pumpkin flavored products in 2019 totaled nearly $489 million – up nearly 16% from the year before. These numbers are expected to only increase every year.

Works Cited

Bull. “Pumpkin Spice Latte Is Just One Part Of Starbucks' Growth Story.” Seeking Alpha, 27 Sept. 2016, seekingalpha.com/article/4008787-pumpkin-spice-latte-just-one-part-starbucks-growth-story.

Callahan, Molly, and Molly Callahan. “Welcome to the 'Pumpkin Spice Economy'.” News Northeastern Welcome to the Pumpkin Spice Economy Comments, 30 Aug. 2018, news.northeastern.edu/2018/08/30/welcome-to-the-pumpkin-spice-economy/.

Friedman, Megan. “Sorry, Autumn Lovers: It Looks Like Pumpkin Spice Is On Its Way Out.” Redbook, Redbook, 23 Oct. 2017, www.redbookmag.com/food-recipes/news/a39677/pumpkin-spice-flavor-trend/.

“Yes, Pumpkin Spice Season Is Creeping Earlier Every Year - and This Chart Proves It.” Google, Google, www.google.com/amp/s/www.marketwatch.com/amp/story/guid/5F88512E-C43E-11E9-9281-1A808DCFBD71.

A collaboration between economics and personal finance classes at Pewaukee High School. All content and views published on here are solely those of the author of the piece and do not represent the views of Pewaukee High School nor the Pewaukee School District.

Thursday, October 31, 2019

The Effect of Trump's Tariffs on the Secondary Sneaker Market

Economics Blog: The Effect of Trump’s Tariffs on the Secondary Sneaker Market

Griffin Goyette

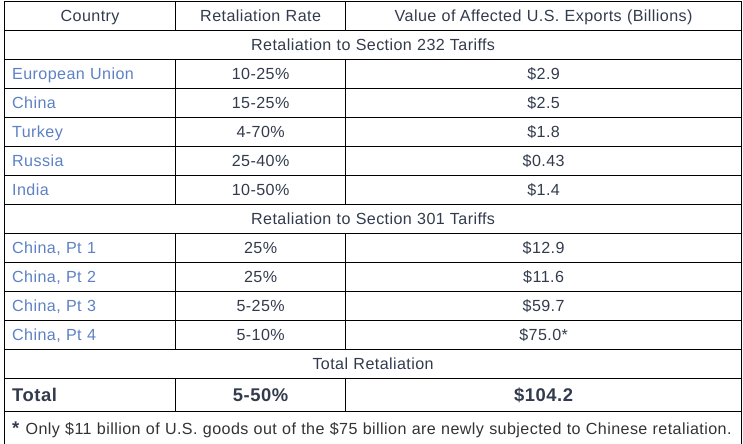

On August 23, 2019 president Donald Trump released a tariff on most imported goods from China. This Tariff did no include sneakers along with most clothes imported from China, but around the same time, this tariff was released Trump proposed another 10% increase on this tariff that would affect all imported goods from China. This means there would be a 25% tariff on all imported goods from China including sneakers. This new 25% tariff would increase the retail price of most sneakers which can affect the secondary sneaker market and the resale value of sneakers. The Secondary sneaker market is when people purchase limited shoes and resell them for more than the retail price.

https://www.americanactionforum.org/research/the-total-cost-of-trumps-new-tariffs/

The 15% tariff that is in place has already affected the secondary sneaker market even though this tariff doesn't tax the import of sneakers. The secondary market has seen a spike in a handful of shoes that are released only in China. For example, Jordan 1 not for resell which released only in New York and China on its original release date had an almost 400$ price jump since the tariff. Currently, there isn’t really a solution to how the tariff is affecting the secondary shoe market but if the spikes in price continue it could lead to a lot of shoes sitting at prices people cant afford causing the secondary market to either freeze or collapse. Many shoe enthusiasts say that after a while the prices will return to normal but is that really going to be the case?

Sources:

https://www.complex.com/sneakers/2019/05/how-president-trumps-new-chinese-import-tariffs-could-affect-the-sneaker-world

https://footwearnews.com/2019/business/retail/trump-china-tariffs-sneaker-prices-1202784401/

https://www.youtube.com/watch?v=S7sFWEJuCYU

Griffin Goyette

On August 23, 2019 president Donald Trump released a tariff on most imported goods from China. This Tariff did no include sneakers along with most clothes imported from China, but around the same time, this tariff was released Trump proposed another 10% increase on this tariff that would affect all imported goods from China. This means there would be a 25% tariff on all imported goods from China including sneakers. This new 25% tariff would increase the retail price of most sneakers which can affect the secondary sneaker market and the resale value of sneakers. The Secondary sneaker market is when people purchase limited shoes and resell them for more than the retail price.

https://www.americanactionforum.org/research/the-total-cost-of-trumps-new-tariffs/

The 15% tariff that is in place has already affected the secondary sneaker market even though this tariff doesn't tax the import of sneakers. The secondary market has seen a spike in a handful of shoes that are released only in China. For example, Jordan 1 not for resell which released only in New York and China on its original release date had an almost 400$ price jump since the tariff. Currently, there isn’t really a solution to how the tariff is affecting the secondary shoe market but if the spikes in price continue it could lead to a lot of shoes sitting at prices people cant afford causing the secondary market to either freeze or collapse. Many shoe enthusiasts say that after a while the prices will return to normal but is that really going to be the case?

Sources:

https://www.complex.com/sneakers/2019/05/how-president-trumps-new-chinese-import-tariffs-could-affect-the-sneaker-world

https://footwearnews.com/2019/business/retail/trump-china-tariffs-sneaker-prices-1202784401/

https://www.youtube.com/watch?v=S7sFWEJuCYU

Wednesday, October 30, 2019

How to Afford Your First Car

How to Afford Your First Car

Alexis Rebholz

Being new drivers the majority of Pewaukee high school either has their first car or is looking for their first car. In this article, It will show smart tips and tricks to keep in mind when looking for that car.

The first tip to follow when searching for a car is to shop smart. In a study done by AutoTrader.com approximately 41% of parents said they paid in full or at least half of their son/daughter’s first car. Therefore, more likely than not, at least some of the expenses will be paid for, which either goes to the price of the car itself or paying for insurance. Assuming that there will still be a large portion that you will have to be paying for there are some rules to follow. Looking at the fun, fancy, cool-looking convertibles would not be your best bet, especially in Wisconsin winter when the top gets stuck down, very cool. So style is not always key, finding cheap but a reliable used car would be the smartest choice in most scenarios. Those 2-5 grand cars that you find in smaller dealerships will usually provide the best price for what you are getting. Another smart rule is to think about your personal travel needs. If all you do is drive yourself to school/work then back home you wouldn’t need the extra expense of backseat butt warmers, you would need good gas mileage that would last.

Lastly would be to budget. Saving up for a car is a huge expense and on top of the initial expenses, there are other long term expenses to keep in minds such as gas, oil changes, and emergencies. By putting away a small portion of your paycheck each month that can be used for all vehicle expenses. Once you have enough saved to purchase the car/ put the first payment in you should save about 25% of that amount to put into an emergency fund. Although buying a cheap car is a fantastic idea money wise, if the car ends up breaking or something goes wrong it can turn into what I call a “Garbo car”. Owning a garbo car can cause major troubles if breaks wear out or if worse comes to worst the transmission breaks, so having an emergency fund is crucial to have.

Buying your first car can be scary and there are many more things to look into before spending that much money but with time and good research, anyone can become an expert.

Alexis Rebholz

Being new drivers the majority of Pewaukee high school either has their first car or is looking for their first car. In this article, It will show smart tips and tricks to keep in mind when looking for that car.

The first tip to follow when searching for a car is to shop smart. In a study done by AutoTrader.com approximately 41% of parents said they paid in full or at least half of their son/daughter’s first car. Therefore, more likely than not, at least some of the expenses will be paid for, which either goes to the price of the car itself or paying for insurance. Assuming that there will still be a large portion that you will have to be paying for there are some rules to follow. Looking at the fun, fancy, cool-looking convertibles would not be your best bet, especially in Wisconsin winter when the top gets stuck down, very cool. So style is not always key, finding cheap but a reliable used car would be the smartest choice in most scenarios. Those 2-5 grand cars that you find in smaller dealerships will usually provide the best price for what you are getting. Another smart rule is to think about your personal travel needs. If all you do is drive yourself to school/work then back home you wouldn’t need the extra expense of backseat butt warmers, you would need good gas mileage that would last.

Lastly would be to budget. Saving up for a car is a huge expense and on top of the initial expenses, there are other long term expenses to keep in minds such as gas, oil changes, and emergencies. By putting away a small portion of your paycheck each month that can be used for all vehicle expenses. Once you have enough saved to purchase the car/ put the first payment in you should save about 25% of that amount to put into an emergency fund. Although buying a cheap car is a fantastic idea money wise, if the car ends up breaking or something goes wrong it can turn into what I call a “Garbo car”. Owning a garbo car can cause major troubles if breaks wear out or if worse comes to worst the transmission breaks, so having an emergency fund is crucial to have.

Buying your first car can be scary and there are many more things to look into before spending that much money but with time and good research, anyone can become an expert.

Traveling on a Budget

Traveling on a Budget

Kristina Harms

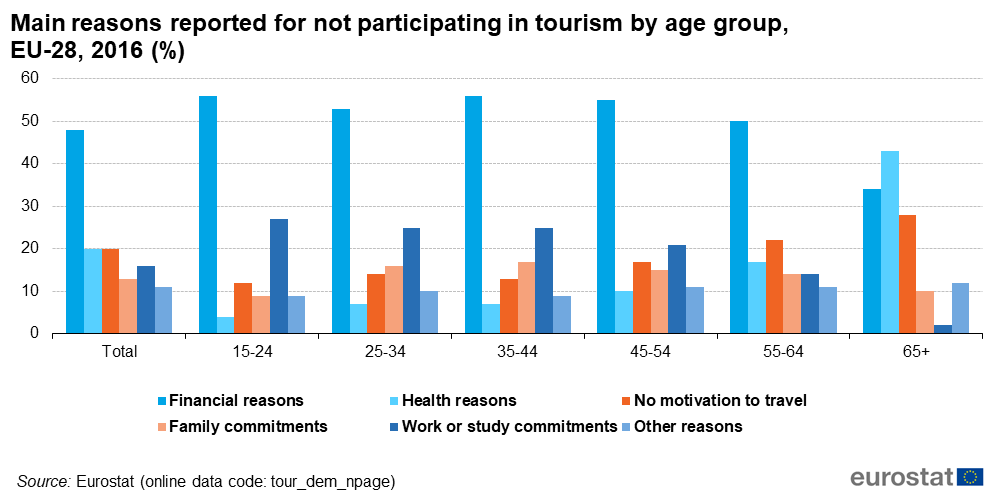

Traveling across the world is on many people's bucket list but, to do this requires money and usually lots of it. So, what if I told you there were ways around that expensive price tag. The average cost per person to go on vacation is around $1,200 and this price can vary dramatically depending on where in the world you plan on traveling to. As someone who plans to travel to as many countries as I can, I was curious about not only the ways to cut down on cost, but also how the travel industry affects the economy in general. According to the U.S. Travel Association “Travel is among the top 10 industries in 49 states and D.C. in terms of employment.” This not only proves the importance of travel on our economy but, it is basically saying that travel is necessary for our society and the societies we visit around the world. Without further ado, here are my tips on how to travel on a budget.

The first money saving tip is to travel during the off season. I know you might want to visit Hawaii to get away from the snow back home, but so does everybody else. Traveling during high traffic times of the year is when the airlines raise prices dramatically. The best time to travel during the year is the month of January. According to Kelly Soderlund in Where to go 2019 “January historically is the cheapest month to fly for both domestic and international destinations, with domestic airfare 31 percent lower on average than peak summertime booking prices.” The overall money this would save you could make the difference when deciding if you can afford the trip.

The second money saving tip is to stay in hostels. Hostels are a great alternative to expensive hotel rooms. Hostels range from around $20 to at most $100 dollars a night depending on the city you’re staying in. This is a drastic difference from the going rate of a hotel room which can cost around $200 to $300 per night. These costs can add up quickly when staying for multiple nights at a time. So, the cutting of the cost in more than half, will be a large money saver in the long run. Hostels also usually have complimentary breakfast for their guests. This is yet another perk of the hostel and eliminates the cost of one of your meals for the day.

The final money saving tip I have for you is to shop at the local grocery stores. Wait just a minute, just hear me out. According to the World Food Travel Association “By our estimate, visitors spend approximately 25% of their travel budget on food and beverages. The figure can get as high as 35% in expensive destinations, and as low as 15% on more affordable destinations.” This means that a large sum of the expenses you face on travels is due to the fact that you’re eating out for all of your meals. Instead, shop at the local grocery store and cook some of the meals yourself. You can still get an authentic dish from that region but with the perk of a much smaller price tag.

Overall, money should not be a deterient when wanting to travel. There are so many different ways you can cut down the price and I only touched on a few of the bigger cost cutting techniques. Whether you cut down on the cost through the food bills, the airfare, the cost or some of the many other techniques, you will always be able to find a way to save.

Greenspan, Rachel E. “How to Travel for Free: 6 Ways to Vacation for Cheap.” Time, Time, 1 Feb. 2019, time.com/5466091/travel-for-cheap-free-budget/.

Soderlund, Kelly. “When to Go 2019.” Tailwind by Hipmunk, 14 Jan. 2019, www.hipmunk.com/tailwind/when-to-go-2019/.

“This Chart Will Help You Find the Cheapest Month to Fly to 60 Different U.S. Cities.” Money, money.com/money/5482931/this-chart-will-help-you-find-the-cheapest-month-to-fly-to-60-different-u-s-cities/.

“Tourism Statistics - Participation in Tourism.” Tourism Statistics - Participation in Tourism - Statistics Explained, ec.europa.eu/eurostat/statistics-explained/index.php/Tourism_statistics_-_participation_in_tourism.

“Travel Facts and Figures.” U.S. Travel Association, www.ustravel.org/research/travel-facts-and-figures.

“What Is Food Tourism.” World Food Travel Association, worldfoodtravel.org/what-is-food-tourism/.

Kristina Harms

Traveling across the world is on many people's bucket list but, to do this requires money and usually lots of it. So, what if I told you there were ways around that expensive price tag. The average cost per person to go on vacation is around $1,200 and this price can vary dramatically depending on where in the world you plan on traveling to. As someone who plans to travel to as many countries as I can, I was curious about not only the ways to cut down on cost, but also how the travel industry affects the economy in general. According to the U.S. Travel Association “Travel is among the top 10 industries in 49 states and D.C. in terms of employment.” This not only proves the importance of travel on our economy but, it is basically saying that travel is necessary for our society and the societies we visit around the world. Without further ado, here are my tips on how to travel on a budget.

The first money saving tip is to travel during the off season. I know you might want to visit Hawaii to get away from the snow back home, but so does everybody else. Traveling during high traffic times of the year is when the airlines raise prices dramatically. The best time to travel during the year is the month of January. According to Kelly Soderlund in Where to go 2019 “January historically is the cheapest month to fly for both domestic and international destinations, with domestic airfare 31 percent lower on average than peak summertime booking prices.” The overall money this would save you could make the difference when deciding if you can afford the trip.

The second money saving tip is to stay in hostels. Hostels are a great alternative to expensive hotel rooms. Hostels range from around $20 to at most $100 dollars a night depending on the city you’re staying in. This is a drastic difference from the going rate of a hotel room which can cost around $200 to $300 per night. These costs can add up quickly when staying for multiple nights at a time. So, the cutting of the cost in more than half, will be a large money saver in the long run. Hostels also usually have complimentary breakfast for their guests. This is yet another perk of the hostel and eliminates the cost of one of your meals for the day.

The final money saving tip I have for you is to shop at the local grocery stores. Wait just a minute, just hear me out. According to the World Food Travel Association “By our estimate, visitors spend approximately 25% of their travel budget on food and beverages. The figure can get as high as 35% in expensive destinations, and as low as 15% on more affordable destinations.” This means that a large sum of the expenses you face on travels is due to the fact that you’re eating out for all of your meals. Instead, shop at the local grocery store and cook some of the meals yourself. You can still get an authentic dish from that region but with the perk of a much smaller price tag.

Overall, money should not be a deterient when wanting to travel. There are so many different ways you can cut down the price and I only touched on a few of the bigger cost cutting techniques. Whether you cut down on the cost through the food bills, the airfare, the cost or some of the many other techniques, you will always be able to find a way to save.

Work Cited

Draper, David, et al. “45 Travel Hacks That Can Save You $$$!” Hostelworld Blog, 29 Aug. 2018, www.hostelworld.com/blog/travel-on-a-budget/.Greenspan, Rachel E. “How to Travel for Free: 6 Ways to Vacation for Cheap.” Time, Time, 1 Feb. 2019, time.com/5466091/travel-for-cheap-free-budget/.

Soderlund, Kelly. “When to Go 2019.” Tailwind by Hipmunk, 14 Jan. 2019, www.hipmunk.com/tailwind/when-to-go-2019/.

“This Chart Will Help You Find the Cheapest Month to Fly to 60 Different U.S. Cities.” Money, money.com/money/5482931/this-chart-will-help-you-find-the-cheapest-month-to-fly-to-60-different-u-s-cities/.

“Tourism Statistics - Participation in Tourism.” Tourism Statistics - Participation in Tourism - Statistics Explained, ec.europa.eu/eurostat/statistics-explained/index.php/Tourism_statistics_-_participation_in_tourism.

“Travel Facts and Figures.” U.S. Travel Association, www.ustravel.org/research/travel-facts-and-figures.

“What Is Food Tourism.” World Food Travel Association, worldfoodtravel.org/what-is-food-tourism/.

Monday, October 28, 2019

Don’t Be Fooled by the Looks of Art School

Don’t Be Fooled by the Looks of Art School

Sara Laszkiewicz

Approximately 2.5 million people in the United States alone are employed as artists (Bureau of Labor Statistics). It is assumed that to achieve and receive the best art education and the best future career in the art field, the best plan is to attend art school. No matter the amount of awards that specific school has received, the amount of prestige the art school presents, or even the amount of success that certain alumni have received after art school. Being that most art schools are private not for profit institutions, they present significantly higher tuition rate. Meaning that students will receive a higher amount of student loans and higher amount of debt in the future. Art school may not be the most economical nor reasonable choice to receive a Fine Arts degree.

“7 of the top 10 most expensive schools in the U.S. (after scholarships and aid) are art schools” (Artists Report Back; BFAMFAPhD 2014). A majority of art schools are declared private institutions that are only funded by their increased yearly tuition or by generous donations. 30% of art school tuition in the 2016-17 academic year ended up being apart of the institution's funds which lead to a total of $243 billion of total revenue.

Percentage distribution of total revenues at degree-granting postsecondary institutions for each control of institution, by source of funds: 2016–17

As young adults entering into the real world, a large majority of this population can not currently pay for a 4-year post-secondary education out of pocket. We are primarily looking at financial aid and student loans to cover any type of college tuition costs. According to the College for Creative Studies which is a private not for profit art school in Detroit, Michigan, “98% of students receive financial aid. CCS is affordable.” How can this art school say that they have affordable pricing when a majority of their student body is, in the end, going to have to be paying approximately $32,600 worth of debt (in 2017) a year? They can’t, it is simply an advertising ploy to entice young adults who are interested in art into believing that they will save a significant amount of tuition if you attend their institution. Even students at some of the largest and most prestigious art schools, have a hard time paying their student loans back. According to the Artists Report Back study completed in 2014, 13% of Ringling School of Art and Design students defaulted on their loans (were not able to pay their loans within the agreed amount of time). 11% of Berklee College of Music students defaulted their loans, 10% of Pratt Institute students defaulted on their loans. No matter where any of these students come from, the amount of student tuition and debt that is expected to be paid right out of college, can be extremely difficult for a large population of art school graduates to handle.

You are most likely wondering if art school is going to break your bank account, where should I go to get a fine arts degree? The best way to still earn the education needed to blossom in the art world without paying tens of thousands of dollars in debt is to attend either a public-in state 4-year university majoring in your specific art focus. Or to instead choose to start at a 2-year technical college that contains the art major you want to study. According to U.S. News, the average tuition for a 4-year in-state school was approximately $9,716 a year (in the 2018-19 academic year). Whereas the average 2-year technical college tuition in the state of Wisconsin approximately $4,095 a year. Which is significantly lower amount of tuition then paying $35,676 a year to attend private art school. It doesn’t matter the path that you take to reach your desired dream career/job, what matters is having a financially stable job in the end. It doesn’t matter if you end up getting an associate's degree in art/design or you get a 4-year Fine Arts degree, if you can find a lifelong career. While looking and imagining yourself studying art 24/7 sounds like the ultimate dream for an artist, don’t forget to consider your current financial situation and how these current college decisions can affect your financial future.

You are most likely wondering if art school is going to break your bank account, where should I go to get a fine arts degree? The best way to still earn the education needed to blossom in the art world without paying tens of thousands of dollars in debt is to attend either a public-in state 4-year university majoring in your specific art focus. Or to instead choose to start at a 2-year technical college that contains the art major you want to study. According to U.S. News, the average tuition for a 4-year in-state school was approximately $9,716 a year (in the 2018-19 academic year). Whereas the average 2-year technical college tuition in the state of Wisconsin approximately $4,095 a year. Which is significantly lower amount of tuition then paying $35,676 a year to attend private art school. It doesn’t matter the path that you take to reach your desired dream career/job, what matters is having a financially stable job in the end. It doesn’t matter if you end up getting an associate's degree in art/design or you get a 4-year Fine Arts degree, if you can find a lifelong career. While looking and imagining yourself studying art 24/7 sounds like the ultimate dream for an artist, don’t forget to consider your current financial situation and how these current college decisions can affect your financial future.

“Craft and Fine Artists : Occupational Outlook Handbook:” U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics.

Jahoda, Susan, et al. “Artists Report Back: A National Study on the Lives of Arts Graduates and Working Artists.” Edited by Caron Atlas et al., BFAMFAPhD, BFAMFAPhD, 2014.

MyCollegeGuide.org. “College Terminology Decoded: For-Profit, Nonprofit, Private and Public Universities.” My College Guide, 16 June 2017.

“New Report Reveals Findings on Artists and Other Cultural Workers.” NEA, 24 Apr. 2019.

“Public Vs. Private Colleges.” My College Options - Public Vs. Private Colleges.

“Student Loan Resources: Financial Aid & Loan Debt Management.” Debt.org.

The Condition of Education - Postsecondary Education - Finances and Resources - Postsecondary Institution Revenues - Indicator May (2019).

“The Cost of Private vs. Public Colleges.” U.S. News & World Report, U.S. News & World Report.

“Tuition & Aid.” College for Creative Studies.

“Tuition and Material Fees.” Wisconsin Technical Colleges, 2 Aug. 2019.

“What Does It Mean to ‘Default’ on My Federal Student Loans?” Consumer Financial Protection Bureau.

Sara Laszkiewicz

Approximately 2.5 million people in the United States alone are employed as artists (Bureau of Labor Statistics). It is assumed that to achieve and receive the best art education and the best future career in the art field, the best plan is to attend art school. No matter the amount of awards that specific school has received, the amount of prestige the art school presents, or even the amount of success that certain alumni have received after art school. Being that most art schools are private not for profit institutions, they present significantly higher tuition rate. Meaning that students will receive a higher amount of student loans and higher amount of debt in the future. Art school may not be the most economical nor reasonable choice to receive a Fine Arts degree.

“7 of the top 10 most expensive schools in the U.S. (after scholarships and aid) are art schools” (Artists Report Back; BFAMFAPhD 2014). A majority of art schools are declared private institutions that are only funded by their increased yearly tuition or by generous donations. 30% of art school tuition in the 2016-17 academic year ended up being apart of the institution's funds which lead to a total of $243 billion of total revenue.

Percentage distribution of total revenues at degree-granting postsecondary institutions for each control of institution, by source of funds: 2016–17

As young adults entering into the real world, a large majority of this population can not currently pay for a 4-year post-secondary education out of pocket. We are primarily looking at financial aid and student loans to cover any type of college tuition costs. According to the College for Creative Studies which is a private not for profit art school in Detroit, Michigan, “98% of students receive financial aid. CCS is affordable.” How can this art school say that they have affordable pricing when a majority of their student body is, in the end, going to have to be paying approximately $32,600 worth of debt (in 2017) a year? They can’t, it is simply an advertising ploy to entice young adults who are interested in art into believing that they will save a significant amount of tuition if you attend their institution. Even students at some of the largest and most prestigious art schools, have a hard time paying their student loans back. According to the Artists Report Back study completed in 2014, 13% of Ringling School of Art and Design students defaulted on their loans (were not able to pay their loans within the agreed amount of time). 11% of Berklee College of Music students defaulted their loans, 10% of Pratt Institute students defaulted on their loans. No matter where any of these students come from, the amount of student tuition and debt that is expected to be paid right out of college, can be extremely difficult for a large population of art school graduates to handle.

Works Cited

AbigailJHess. “Here's How Much the Average Student Loan Borrower Owes When They Graduate.” CNBC, CNBC, 20 May 2019.“Craft and Fine Artists : Occupational Outlook Handbook:” U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics.

Jahoda, Susan, et al. “Artists Report Back: A National Study on the Lives of Arts Graduates and Working Artists.” Edited by Caron Atlas et al., BFAMFAPhD, BFAMFAPhD, 2014.

MyCollegeGuide.org. “College Terminology Decoded: For-Profit, Nonprofit, Private and Public Universities.” My College Guide, 16 June 2017.

“New Report Reveals Findings on Artists and Other Cultural Workers.” NEA, 24 Apr. 2019.

“Public Vs. Private Colleges.” My College Options - Public Vs. Private Colleges.

“Student Loan Resources: Financial Aid & Loan Debt Management.” Debt.org.

The Condition of Education - Postsecondary Education - Finances and Resources - Postsecondary Institution Revenues - Indicator May (2019).

“The Cost of Private vs. Public Colleges.” U.S. News & World Report, U.S. News & World Report.

“Tuition & Aid.” College for Creative Studies.

“Tuition and Material Fees.” Wisconsin Technical Colleges, 2 Aug. 2019.

“What Does It Mean to ‘Default’ on My Federal Student Loans?” Consumer Financial Protection Bureau.

To Chunk or Not to Chunk? What’s With All These FILAs?

To Chunk or Not to Chunk? What’s With All These FILAs?

Manal Hasan

Fashion is ever changing and completely unpredictable. Like when Kim Kardashian wore those clear, glass heels and you could see the condensation on the sides. Or when Lady Gaga wore that meat dress. High profile celebrities will do whatever it takes to be and stay relevant, but today’s trend of chunky FILAs that everyday consumers take part in has nothing to do with how cute the shoe is. Instead, it has to do with how well FILA has been able to market their shoe to our (gullible) generation.

Fashion is ever changing and completely unpredictable. Like when Kim Kardashian wore those clear, glass heels and you could see the condensation on the sides. Or when Lady Gaga wore that meat dress. High profile celebrities will do whatever it takes to be and stay relevant, but today’s trend of chunky FILAs that everyday consumers take part in has nothing to do with how cute the shoe is. Instead, it has to do with how well FILA has been able to market their shoe to our (gullible) generation.

It’s not because they’re pretty, that’s for sure. Instead, FILA has milked their marketing team to the bone, emphasizing the “throwback” and “nineties nostalgia” vibe to their consumers. FILA sells ugly shoes and they know it too: Louis Colon III, the director of heritage for FILA North America said “when you see brands in high, high fashion selling the ugly shoe, the bulky shoe — we have had this in our brand DNA since 1993.” FILA claims to have pioneered the bulky shoe trend, noting that high fashion brands like Balenciaga (shown top right), Fendi, and even Kanye West’s Yeezys (shown bottom right) are benefiting from their niche. But at the end of the day, FILA knows what’s in, and it’s the nineties. Today’s trends were popular 19 years ago and FILA and other throwback brands like Champion are simply riding the wave. It can be hard to explain why changes in taste affect a product’s demand, but it’s proven with the substantial increase in sales and relevancy of these bulky shoes that when tastes change in favor of a good, the demand for it increases, too.

It’s not because they’re pretty, that’s for sure. Instead, FILA has milked their marketing team to the bone, emphasizing the “throwback” and “nineties nostalgia” vibe to their consumers. FILA sells ugly shoes and they know it too: Louis Colon III, the director of heritage for FILA North America said “when you see brands in high, high fashion selling the ugly shoe, the bulky shoe — we have had this in our brand DNA since 1993.” FILA claims to have pioneered the bulky shoe trend, noting that high fashion brands like Balenciaga (shown top right), Fendi, and even Kanye West’s Yeezys (shown bottom right) are benefiting from their niche. But at the end of the day, FILA knows what’s in, and it’s the nineties. Today’s trends were popular 19 years ago and FILA and other throwback brands like Champion are simply riding the wave. It can be hard to explain why changes in taste affect a product’s demand, but it’s proven with the substantial increase in sales and relevancy of these bulky shoes that when tastes change in favor of a good, the demand for it increases, too.

Manal Hasan

Just 3 years ago, FILAs were nothing in comparison to their competitors, Nike and Adidas. The two brands have dominated the shoe industry with help from many celebrity, mainly athlete endorsers. These two brands have been on top in terms of popularity, but from 2016 to 2018, FILA’s sales increased 205% from 821 million dollars to 2.51 billion dollars. Let me restate that: in just two years, FILA has evolved from a multi-million company to a multi-billion dollar company. How does clunky, chunky FILA shoe go from completely off the grid to swagily adorned by every hype-beast kid in high schools everywhere?

So, even though the shoes are ugly, consumers can’t help but succumb to peer pressure and buy what's in. We are victim to wanting to fit in, and FILA knows it, too. From selling their shoes in Kohl’s, all the way to Bloomingdales, FILA is conscious and intentional in their strategy to “[make] the brand a fashion brand and [market] to a younger consumer, applying new techniques.” FILA has capitalized on taking casual culture into a fashion experience, targeting today’s youth as their key consumers. Though they are lowkey in their advertising (sans any major brand ambassadors), social media has been their method to display the bulky shoes to their targeted demographic of fashion conscious people who want to add the cool, sporty look to their lifestyle. As of right now, FILA has convinced us all that the hottest trend in footwear is the “ugly” shoe movement, and man are they doin’ a great job at finessing their way to the top with that logic.

Works Cited

Hershman, Brett. “How Changing Trends Resurrected FILA As A Fashion Brand.” Benzinga,

Benzinga, 27 Nov. 2017, www.benzinga.com/news/17/11/10813099/how-changing-trends-resurrected-fila-as-a-fashion-brand.

Shirtay. “How a '90s Nostalgia Trend Powered the Comeback of Two Century-Old Sports Brands.” CNBC, CNBC, 19 June 2019, www.cnbc.com/2019/06/19/how-a-90s-nostalgia-trend-powered-the-comeback-of-champion-and-fila.html.

Turner, David. “How Fila Snuck Back Into Favor.” The New Yorker, The New Yorker, 9 Oct. 2018, www.newyorker.com/culture/on-and-off-the-avenue/how-fila-snuck-back-into-favor.

Zigu. “Fila SWOT Analysis: Competitors & USP: BrandGuide.” MBA Skool-Study.Learn.Share., www.mbaskool.com/brandguide/lifestyle-and-retail/2833-fila.html.

Thursday, October 24, 2019

How You as a Student Can Start Investing with Little Effort Today

How You as a Student Can Start Investing with Little Effort Today

Sean Collar

Economics A2

Many adults wish they started investing or saving their money younger. Unlike our parents, we have the tools needed to start investing, and yes, you can start today. In less than 5 minutes, I will give you some amazing ways you can begin your investing adventure, all with pretty minimal risk.

Investing is of utmost importance, and there are many reasons to support this. First and foremost, by simply keeping your money in a bank account, and never spending it, you are actually losing money. This is due to the annual inflation rate exceeding the APY (Annual Percentage Rate). The average savings account has a 0.06% APY. The annual inflation rate normally sits around 2%. This means you are always losing at least 1% of your money each year. $10 of your $1000 is now gone, literally by “saving” it.

So you want to start making your money “work for you”. One of the easiest ways to do this is to use a high interest savings account. Ally.com offers a 1.8% APY, 30 times the national average. This will help your savings keep up with the inflation rate. Using a high interest savings account like ally.com is the simplest way of “investing”.

Next is a way to automate your investing, without you even noticing. Acorns is an app that does this for you. Let’s say you buy a coffee for $3.60. Acorns will round that up to $4.00 and invest the difference, $0.40, in companies and mutual funds that match your interests and goals. I personally love this concept, and use it myself. For any of you who don’t have time to research companies about which to invest in, Acorns is great. You answer a couple questions, setup your account, and just by making your daily purchases, you are investing. You can also double, even triple your round-ups, as well as make recurring investments on a daily, weekly, or monthly basis.

For those of you who have some extra time to research your investments, or just want to invest in actual stocks, let me introduce Stash Invest, the newest of these companies. Stash allows their users to invest in fractional shares of hundreds of public companies, mutual funds, ETFs, and more. Oh, and one more thing. The trades are commission free, unlike most other brokers. This means you can buy more shares of a company instead of putting it towards a fee. Stash also allows automated investing, meaning it will execute trades for you on a daily, weekly, or monthly basis.

Investing is crucial to achieving financial freedom, and also to having an enjoyable life after retirement, worry free. With an annual return of 7%, your money will double every 10 years. Another thing to keep in mind is that the more research and time you put into your investments, larger returns are likely. Starting to invest today, while time is on your side.

Works Cited

Anspach, Dana. “Keep Reality in Mind When Looking for a Good Return on Your Investment.” The Balance, The Balance, 25 June 2019, www.thebalance.com/what-is-a-good-return-on-investment-2388458.

“Invest, Earn, Grow, Spend, Later.” Acorns, www.acorns.com/.

“What Is APY and How Is It Calculated?” Do It Right, 20 Aug. 2019, www.ally.com/do-it-right/banking/how-is-annual-percentage-yield-calculated/.

Sean Collar

Economics A2

Many adults wish they started investing or saving their money younger. Unlike our parents, we have the tools needed to start investing, and yes, you can start today. In less than 5 minutes, I will give you some amazing ways you can begin your investing adventure, all with pretty minimal risk.

Investing is of utmost importance, and there are many reasons to support this. First and foremost, by simply keeping your money in a bank account, and never spending it, you are actually losing money. This is due to the annual inflation rate exceeding the APY (Annual Percentage Rate). The average savings account has a 0.06% APY. The annual inflation rate normally sits around 2%. This means you are always losing at least 1% of your money each year. $10 of your $1000 is now gone, literally by “saving” it.

So you want to start making your money “work for you”. One of the easiest ways to do this is to use a high interest savings account. Ally.com offers a 1.8% APY, 30 times the national average. This will help your savings keep up with the inflation rate. Using a high interest savings account like ally.com is the simplest way of “investing”.

Next is a way to automate your investing, without you even noticing. Acorns is an app that does this for you. Let’s say you buy a coffee for $3.60. Acorns will round that up to $4.00 and invest the difference, $0.40, in companies and mutual funds that match your interests and goals. I personally love this concept, and use it myself. For any of you who don’t have time to research companies about which to invest in, Acorns is great. You answer a couple questions, setup your account, and just by making your daily purchases, you are investing. You can also double, even triple your round-ups, as well as make recurring investments on a daily, weekly, or monthly basis.

For those of you who have some extra time to research your investments, or just want to invest in actual stocks, let me introduce Stash Invest, the newest of these companies. Stash allows their users to invest in fractional shares of hundreds of public companies, mutual funds, ETFs, and more. Oh, and one more thing. The trades are commission free, unlike most other brokers. This means you can buy more shares of a company instead of putting it towards a fee. Stash also allows automated investing, meaning it will execute trades for you on a daily, weekly, or monthly basis.

Investing is crucial to achieving financial freedom, and also to having an enjoyable life after retirement, worry free. With an annual return of 7%, your money will double every 10 years. Another thing to keep in mind is that the more research and time you put into your investments, larger returns are likely. Starting to invest today, while time is on your side.

Works Cited

Anspach, Dana. “Keep Reality in Mind When Looking for a Good Return on Your Investment.” The Balance, The Balance, 25 June 2019, www.thebalance.com/what-is-a-good-return-on-investment-2388458.

“Invest, Earn, Grow, Spend, Later.” Acorns, www.acorns.com/.

“What Is APY and How Is It Calculated?” Do It Right, 20 Aug. 2019, www.ally.com/do-it-right/banking/how-is-annual-percentage-yield-calculated/.

Is Hosting the Olympics Worth the Money?

Is Hosting the Olympics Worth the Money?

Bella Galewski

The Olympics started in Ancient day Greece and evolved into what is now the modern-day Olympics. It brings in thousands of tourists from all over the world. And therefore also brings in revenue for the cities that host the Olympics. However, there is also a negative of countries hosting the Olympics. The costs. There are many costs for hosting the Olympics, the stadium, the opening ceremony, the closing ceremony, medals, equipment, etc. But is hosting the Olympics worth billions of dollars.

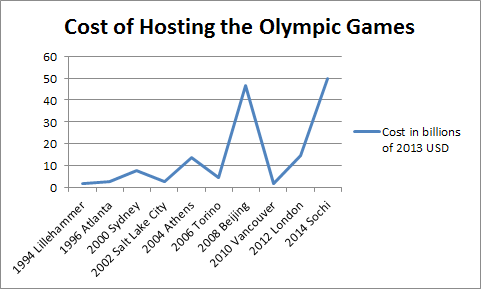

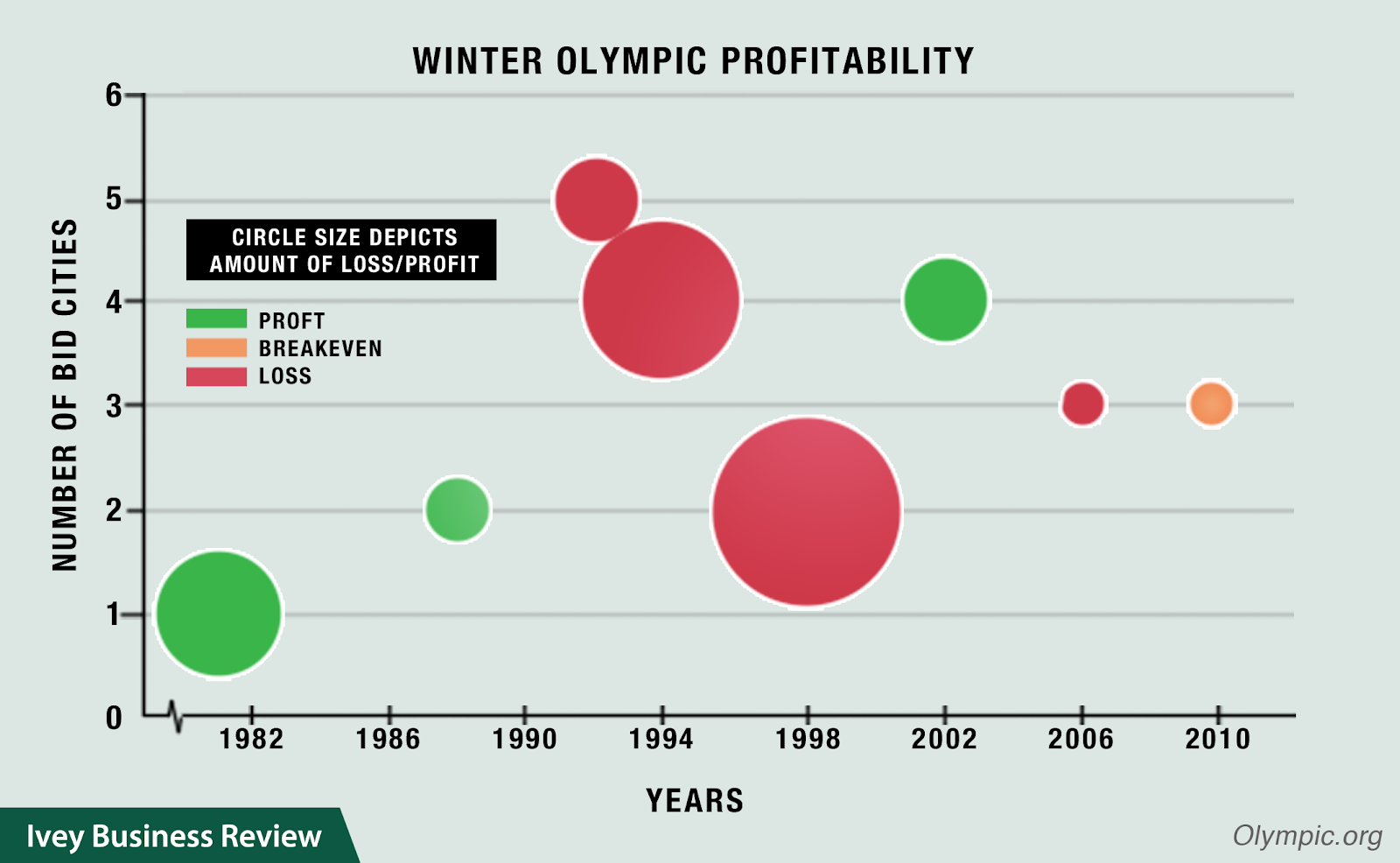

Countries that host the Olympics invest billions of dollars to boost tourism, and build their country more. However, few countries profit from hosting the Olympics. According to Manning and Napier, “Athens’ 2004 Summer Games put Greece $14.5 billion in debt. [...] Los Angeles in 1984 was the first city to profit from hosting the Olympics” (Manning and Napier). The graph to the right reflects the costs of hosting the Olympics for 10 different countries. As you can see, the cost of hosting the Olympics has gone up over the last decade due to more elaborate opening and closing ceremonies and various other expenses. “The first city to profit from the Olympics was in 1984” (Manning and Napier). Our modern-day Olympics didn’t start until 1896. That’s almost a century after the Olympics started. When you factor in all of the costs of running the Olympics, it’s no wonder the demand to host the Olympics has gone down. The opportunity cost of the Olympics is just not worth it. The graph to the left shows the profit/loss/break even for cities that have held the Olympics since 1982. As you can see, cities that did make a profit, had a marginally small profit because the costs of holding the Olympics are very large. The graph contains 8 countries that held the Olympics. Of those 8, only 3 experienced a profit, 4 countries lost money, and only one country broke even, meaning they did not lose or gain money.

Countries do however see a growth in tourism, and sometimes economic growth because the Olympics does bring in thousands of visitors from all over the world. According to Olympic News, the Olympic games of 2016 led to an increase in tourism over the next 12 months for Brazil. Brazil saw a 4.8% increase in foreign tourism. That meant that there were roughly 6.3 million tourists more than Brazil usually had. That’s a lot of tourists. And Rio also had economic growth that didn’t weaken until 2018. According to Olympic News, “job creation accounted for 83% of Rio’s economic growth [...] The income of the poorest 5% also grew 29.3% against 19.96% of the richest 5%” (Olympic News).

After looking at both the cost and benefit of hosting the Olympics, one has to conclude is hosting the Olympics worth the economic growth that may occur, or the economic distress that may occur as a result of the billions of dollars spent. Will the Olympics draw in more revenue or will the city suffer as a result? After looking at the economic impacts of hosting the Olympics, the costs of the games greatly outweigh the benefits of hosting the Olympics. What do you think, are the Olympics worth the money and risk?

Works Cited

“The Economic Impact of the Olympics.” Manning & Napier, www.manning-napier.com/insights/blogs/markets-and-economy/the-economic-impact-of-the-olympics.

Ioc. “Olympic Games Rio 2016 - Economic Legacy.” International Olympic Committee, IOC, 1 Dec. 2018, www.olympic.org/news/olympic-games-rio-2016-economic-legacy.

“Miracle on Mice - Jack Luan: Ivey Business Review.” Jack Luan | Ivey Business Review, 26 Mar. 2014, iveybusinessreview.ca/blogs/jluanhba2015/2014/03/21/miracle-on-mice/.

“The Penn Museum.” Penn Museum, www.penn.museum/sites/olympics/olympicorigins.shtml.

Ptbacon. “The Rugby World Cup Is Coming – but Are the 'Big' Sporting Events Worth the Cost?” Bacon's Grilling, 12 Sept. 2015, baconsgrilling.wordpress.com/2015/09/12/the-rugby-world-cup-is-coming-but-are-the-big-sporting-events-worth-the-cost/.

Bella Galewski

The Olympics started in Ancient day Greece and evolved into what is now the modern-day Olympics. It brings in thousands of tourists from all over the world. And therefore also brings in revenue for the cities that host the Olympics. However, there is also a negative of countries hosting the Olympics. The costs. There are many costs for hosting the Olympics, the stadium, the opening ceremony, the closing ceremony, medals, equipment, etc. But is hosting the Olympics worth billions of dollars.

Countries that host the Olympics invest billions of dollars to boost tourism, and build their country more. However, few countries profit from hosting the Olympics. According to Manning and Napier, “Athens’ 2004 Summer Games put Greece $14.5 billion in debt. [...] Los Angeles in 1984 was the first city to profit from hosting the Olympics” (Manning and Napier). The graph to the right reflects the costs of hosting the Olympics for 10 different countries. As you can see, the cost of hosting the Olympics has gone up over the last decade due to more elaborate opening and closing ceremonies and various other expenses. “The first city to profit from the Olympics was in 1984” (Manning and Napier). Our modern-day Olympics didn’t start until 1896. That’s almost a century after the Olympics started. When you factor in all of the costs of running the Olympics, it’s no wonder the demand to host the Olympics has gone down. The opportunity cost of the Olympics is just not worth it. The graph to the left shows the profit/loss/break even for cities that have held the Olympics since 1982. As you can see, cities that did make a profit, had a marginally small profit because the costs of holding the Olympics are very large. The graph contains 8 countries that held the Olympics. Of those 8, only 3 experienced a profit, 4 countries lost money, and only one country broke even, meaning they did not lose or gain money.

Countries do however see a growth in tourism, and sometimes economic growth because the Olympics does bring in thousands of visitors from all over the world. According to Olympic News, the Olympic games of 2016 led to an increase in tourism over the next 12 months for Brazil. Brazil saw a 4.8% increase in foreign tourism. That meant that there were roughly 6.3 million tourists more than Brazil usually had. That’s a lot of tourists. And Rio also had economic growth that didn’t weaken until 2018. According to Olympic News, “job creation accounted for 83% of Rio’s economic growth [...] The income of the poorest 5% also grew 29.3% against 19.96% of the richest 5%” (Olympic News).

After looking at both the cost and benefit of hosting the Olympics, one has to conclude is hosting the Olympics worth the economic growth that may occur, or the economic distress that may occur as a result of the billions of dollars spent. Will the Olympics draw in more revenue or will the city suffer as a result? After looking at the economic impacts of hosting the Olympics, the costs of the games greatly outweigh the benefits of hosting the Olympics. What do you think, are the Olympics worth the money and risk?

Works Cited

“The Economic Impact of the Olympics.” Manning & Napier, www.manning-napier.com/insights/blogs/markets-and-economy/the-economic-impact-of-the-olympics.

Ioc. “Olympic Games Rio 2016 - Economic Legacy.” International Olympic Committee, IOC, 1 Dec. 2018, www.olympic.org/news/olympic-games-rio-2016-economic-legacy.

“Miracle on Mice - Jack Luan: Ivey Business Review.” Jack Luan | Ivey Business Review, 26 Mar. 2014, iveybusinessreview.ca/blogs/jluanhba2015/2014/03/21/miracle-on-mice/.

“The Penn Museum.” Penn Museum, www.penn.museum/sites/olympics/olympicorigins.shtml.

Ptbacon. “The Rugby World Cup Is Coming – but Are the 'Big' Sporting Events Worth the Cost?” Bacon's Grilling, 12 Sept. 2015, baconsgrilling.wordpress.com/2015/09/12/the-rugby-world-cup-is-coming-but-are-the-big-sporting-events-worth-the-cost/.

Tuesday, October 22, 2019

Our Basic Insurance Needs

Our Basic Insurance Needs

Katie Jackson

Personal & Financial Management A2

10/22/19

Insurance is that thing in the Game of Life that’s constantly leeching money from us, but never seems to be doing anything for us. Though it sometimes seems useless, we all end up paying a monthly bill for something that doesn’t seem so monthly anyway. All for it’s financial coverage in the event of an unexpected occurrence. Some of us may already be paying for some insurance. Even in my own experience, there’s quite an abundance of families that expect their teens to be paying for their own car insurance. However, paying our parents for the car insurance and managing the entirety of our own insurance are two completely different stories.

While many of us will go off and begin to live more independent lives, we’ll start to notice that you can get insurance on just about anything. So what insurance will we really need, and what is worth our money? Not a simple question. Not a simple answer. But, we can start to get a head start now about understanding what we’ll be needing to prepare ourselves for. Looking at the near future, it’s pretty safe to say we’ll all be looking at some bills and payments taxing on our thinning wallets more than we ever have before(what with new bills to pay, rent, loans, saving, investing, etc.). Who wants to be looking at spending money on something they may not even need? But insurance certainly has its place in our budget despite what it may look like.

Just below 27 million people in the US were uninsured in 2016. Consequently, those who are uninsured often have to face unaffordable bills, especially on the medical front. When facing medical obstacles, it’s not as easy to ignore as getting around without a car for a while. These intimidating expenses can quickly snowball into even worse debts. So to prevent that, here’s the basics of basics on what bare minimum insurance we should be looking out for after leaving the nest.

Just below 27 million people in the US were uninsured in 2016. Consequently, those who are uninsured often have to face unaffordable bills, especially on the medical front. When facing medical obstacles, it’s not as easy to ignore as getting around without a car for a while. These intimidating expenses can quickly snowball into even worse debts. So to prevent that, here’s the basics of basics on what bare minimum insurance we should be looking out for after leaving the nest.

Life Insurance

Life insurance is what supports bereaved families that need financial help to deal with the drastic decline of family income. For what it looks like at face value, there doesn’t exactly seem to be a pressing need for the majority of 18-25 year olds who often don’t have kids or spouses yet. Even more so when you look at the fact that these are people who have barely even entered drinking age are generally healthy and youthful, usually not the people we generally think about passing away in the near future. However, this shouldn’t be stopping you from putting the money aside for this one. It can be hard to confront, but despite how unlikely it may seem ensuring safety for the worst is what insurance is for. Though it is often seen as the insurance that protects those who live in a two story houses with a wife/husband, two kids and a dog, life insurance is for everyone. Although you may be the only one relying on your income, this insurance can benefit more than just a spouse and kids (ex. mortgage or college) after passing. You should be able to at the very least pay for your last expenses. This includes a burial. Other things, like yet to be paid medical costs, debt, loans, etc should also be considered. Although not usually legally bound, these expenses have the potential to become your parents or siblings responsibilities if you do not take care of them yourself due to persistent pressuring debt collectors.

Car Insurance

Most of us will probably need car insurance, because owning a car basically requires it. This will protect you if you get into a car accident, your car is stolen, vandalised, or damaged due to natural disaster. The coverage can get pretty broad too (certain types are even required by law). In an accident you can be covered for Liability where it could pay for the damage and medical bills of someone if you hit them, Collision and Comprehension where it covers your troubles, Personal Injury Protection where it covers your passenger’s troubles (medical, funeral costs, etc), and Uninsured or Underinsured Protection for your own property/injury when someone who is uninsured/underinsured causes damage to you or your property.

Health Insurance

Ideally, the hope is that our overall medical expenses will only add up to routine check-ups and over the counter medicine. Unfortunately, this is not an ideal world and when an unexpected and unavoidable emergency comes up that requires an overnight stay at the hospital or even surgery, the bills quickly rack up. Sometimes, the cost of these bills can take years (even decades!) to pay off in certain circumstances. And that’s where our health insurance steps in. Right out of high school, the majority of people will still be on their parents/guardians insurance plans for a good number of years. This is because, technically you can still be included in their plan even if you’re married or do not live with them up to the age of 26, and most people choose to take advantage of the policy once moving out after high school. Perhaps some of us won’t have to worry about this one quite so soon after all.

Renter’s Insurance

This insurance is the protection for your personal belongings stored in your rental property. What is included and covered depends on the policy you have, be it jewelry or technology like a smartphone, laptop, or TV, etc. This will help with stolen or damaged belongings or even the home itself. Even damage due to the negligence of the loaner can be covered depending on your situation. In somewhere like college where you may be residing in the on-campus housing, your parents’ insurance could possibly still cover you on campus, though the policy can vary school to school and plan to plan.

Other

As said before, you can find insurance for practically anything, but there are certain ones we simply shouldn’t go without. In addition to those stated above, there are other pretty important types of insurance we should think about too. For example, disability (what comes after our hospital stay when we’ll no longer be able to return to work?), dental(for similar reasons as health insurance), or even travel(trip cancellation, lost luggage, etc). Every one of these insurances come in all shapes and sizes. There are a variety of plans from a variety of companies for us to choose from. Although it seems daunting, we’ve just got to try and keep it all in perspective while prioritizing and balancing what plans we need most. Simple Life Insure did a poll on what kind of insurance people have, and it’s quite interesting to see how people value their different types of insurance as we can see health being the most popular(above).

As said before, you can find insurance for practically anything, but there are certain ones we simply shouldn’t go without. In addition to those stated above, there are other pretty important types of insurance we should think about too. For example, disability (what comes after our hospital stay when we’ll no longer be able to return to work?), dental(for similar reasons as health insurance), or even travel(trip cancellation, lost luggage, etc). Every one of these insurances come in all shapes and sizes. There are a variety of plans from a variety of companies for us to choose from. Although it seems daunting, we’ve just got to try and keep it all in perspective while prioritizing and balancing what plans we need most. Simple Life Insure did a poll on what kind of insurance people have, and it’s quite interesting to see how people value their different types of insurance as we can see health being the most popular(above).

An infographic with similar arguments:

Marquand, Barbara. “The Parents Guide to Insurance for College Students.” NerdWallet, 12 Aug. 2019, www.nerdwallet.com/blog/insurance/parents-guide-insurance-college-students/.

Mercadante, Kevin, et al. “How Much Does Term Life Insurance Cost?” Money Under 30, www.moneyunder30.com/term-life-insurance-cost.

Published: Dec 07, 2018, and Dec 2018. “Key Facts about the Uninsured Population.” The Henry J. Kaiser Family Foundation, 7 Feb. 2019, www.kff.org/uninsured/fact-sheet/key-facts-about-the-uninsured-population/.

Rose, Jeff. “Best Insurance For College Students in 2019: Life, Health, Auto, Renter's.” Good Financial Cents®, 22 May 2019, www.goodfinancialcents.com/best-insurance-for-college-students/#life.

Vohwinkle, Jeremy. “Why Do I Need Insurance?” The Balance, The Balance, 2 Apr. 2019, www.thebalance.com/insurance-basics-why-do-i-need-insurance-1289684.

Katie Jackson

Personal & Financial Management A2

10/22/19

Insurance is that thing in the Game of Life that’s constantly leeching money from us, but never seems to be doing anything for us. Though it sometimes seems useless, we all end up paying a monthly bill for something that doesn’t seem so monthly anyway. All for it’s financial coverage in the event of an unexpected occurrence. Some of us may already be paying for some insurance. Even in my own experience, there’s quite an abundance of families that expect their teens to be paying for their own car insurance. However, paying our parents for the car insurance and managing the entirety of our own insurance are two completely different stories.

While many of us will go off and begin to live more independent lives, we’ll start to notice that you can get insurance on just about anything. So what insurance will we really need, and what is worth our money? Not a simple question. Not a simple answer. But, we can start to get a head start now about understanding what we’ll be needing to prepare ourselves for. Looking at the near future, it’s pretty safe to say we’ll all be looking at some bills and payments taxing on our thinning wallets more than we ever have before(what with new bills to pay, rent, loans, saving, investing, etc.). Who wants to be looking at spending money on something they may not even need? But insurance certainly has its place in our budget despite what it may look like.

Life Insurance

Life insurance is what supports bereaved families that need financial help to deal with the drastic decline of family income. For what it looks like at face value, there doesn’t exactly seem to be a pressing need for the majority of 18-25 year olds who often don’t have kids or spouses yet. Even more so when you look at the fact that these are people who have barely even entered drinking age are generally healthy and youthful, usually not the people we generally think about passing away in the near future. However, this shouldn’t be stopping you from putting the money aside for this one. It can be hard to confront, but despite how unlikely it may seem ensuring safety for the worst is what insurance is for. Though it is often seen as the insurance that protects those who live in a two story houses with a wife/husband, two kids and a dog, life insurance is for everyone. Although you may be the only one relying on your income, this insurance can benefit more than just a spouse and kids (ex. mortgage or college) after passing. You should be able to at the very least pay for your last expenses. This includes a burial. Other things, like yet to be paid medical costs, debt, loans, etc should also be considered. Although not usually legally bound, these expenses have the potential to become your parents or siblings responsibilities if you do not take care of them yourself due to persistent pressuring debt collectors.

Car Insurance

Most of us will probably need car insurance, because owning a car basically requires it. This will protect you if you get into a car accident, your car is stolen, vandalised, or damaged due to natural disaster. The coverage can get pretty broad too (certain types are even required by law). In an accident you can be covered for Liability where it could pay for the damage and medical bills of someone if you hit them, Collision and Comprehension where it covers your troubles, Personal Injury Protection where it covers your passenger’s troubles (medical, funeral costs, etc), and Uninsured or Underinsured Protection for your own property/injury when someone who is uninsured/underinsured causes damage to you or your property.

Health Insurance

Ideally, the hope is that our overall medical expenses will only add up to routine check-ups and over the counter medicine. Unfortunately, this is not an ideal world and when an unexpected and unavoidable emergency comes up that requires an overnight stay at the hospital or even surgery, the bills quickly rack up. Sometimes, the cost of these bills can take years (even decades!) to pay off in certain circumstances. And that’s where our health insurance steps in. Right out of high school, the majority of people will still be on their parents/guardians insurance plans for a good number of years. This is because, technically you can still be included in their plan even if you’re married or do not live with them up to the age of 26, and most people choose to take advantage of the policy once moving out after high school. Perhaps some of us won’t have to worry about this one quite so soon after all.

Renter’s Insurance

This insurance is the protection for your personal belongings stored in your rental property. What is included and covered depends on the policy you have, be it jewelry or technology like a smartphone, laptop, or TV, etc. This will help with stolen or damaged belongings or even the home itself. Even damage due to the negligence of the loaner can be covered depending on your situation. In somewhere like college where you may be residing in the on-campus housing, your parents’ insurance could possibly still cover you on campus, though the policy can vary school to school and plan to plan.

Other

An infographic with similar arguments:

Works Cited

“3 Reasons to Consider Life Insurance for College Students.” Nationwide, www.nationwide.com/life-insurance-for-college-students.jsp.Marquand, Barbara. “The Parents Guide to Insurance for College Students.” NerdWallet, 12 Aug. 2019, www.nerdwallet.com/blog/insurance/parents-guide-insurance-college-students/.

Mercadante, Kevin, et al. “How Much Does Term Life Insurance Cost?” Money Under 30, www.moneyunder30.com/term-life-insurance-cost.

Published: Dec 07, 2018, and Dec 2018. “Key Facts about the Uninsured Population.” The Henry J. Kaiser Family Foundation, 7 Feb. 2019, www.kff.org/uninsured/fact-sheet/key-facts-about-the-uninsured-population/.

Rose, Jeff. “Best Insurance For College Students in 2019: Life, Health, Auto, Renter's.” Good Financial Cents®, 22 May 2019, www.goodfinancialcents.com/best-insurance-for-college-students/#life.

Vohwinkle, Jeremy. “Why Do I Need Insurance?” The Balance, The Balance, 2 Apr. 2019, www.thebalance.com/insurance-basics-why-do-i-need-insurance-1289684.

Monday, October 21, 2019

Grounding Flights

Sam Preboske

Personal & Financial Management

10/16/19

The excitement of boarding a plane and preparing yourself to fly is a feeling almost all of us have felt once before. However, travelers have been unable to travel by plane for the past 8 months efficiently, leading to massive determinants in revenue and growth plans for the Boeing company. This mass grounding occurred because of two recent plane crashes that sadly resulted in the deaths of over 300 people. Boeing was forced to recall the planes after these unfortunate events and they are still being inspected and fixed to this day. Over 370 max jets have been grounded and have been denied access by different airlines; these planes are extremely fuel efficient and help airlines grow substantially as they don’t have to spend as much on fuel. The loss of access has caused total profit for these airlines to drop significantly and has destroyed the airline economy as a whole.

The excitement of boarding a plane and preparing yourself to fly is a feeling almost all of us have felt once before. However, travelers have been unable to travel by plane for the past 8 months efficiently, leading to massive determinants in revenue and growth plans for the Boeing company. This mass grounding occurred because of two recent plane crashes that sadly resulted in the deaths of over 300 people. Boeing was forced to recall the planes after these unfortunate events and they are still being inspected and fixed to this day. Over 370 max jets have been grounded and have been denied access by different airlines; these planes are extremely fuel efficient and help airlines grow substantially as they don’t have to spend as much on fuel. The loss of access has caused total profit for these airlines to drop significantly and has destroyed the airline economy as a whole.

Recently, American Airlines had to cancel 9,475 flights because of the grounding order which recently hit its pre-tax income of $140 million. The airline said they expect 140 cancellations a day until the planes return. This means that over 14,000 cancelations will occur in the 4th quarter and the beginning of January and the hole that these airlines have found themselves in will only get deeper. American Airlines unfortunately won’t be able to continue their growth plans and will need to start cutting funding to compensate for these cancellations. Airlines are also looking for compensation from Boeing to cover the loss of revenue, however, they have only received flimsy statements “It’s hard until we know when the airplane is really going to be back in service to ascertain what the damages are.” (American Airlines) They also were using the 737 Max a lot “American reports earnings on Oct. 24. The airline had 24 of the 737 Max jets in its fleet at the time of the grounding and has 76 more on order.” This means that the money they used to purchase these planes will not be made back efficiently and that this may put a huge dent into their stock prices. This can be related to our discussions about bonds and how investing in them will yield great profit but has a massive risk involved. Investors may also pull out of Boeing’s stock, as this loss of a huge asset has caused many people to question the company’s management and safety. However, even though Boeing stock did recede, it now is climbing again due to budget cuts and use of older airlines. While this has stopped the massive recession, Boeing’s financial state and management is still a huge mystery.

Recently, American Airlines had to cancel 9,475 flights because of the grounding order which recently hit its pre-tax income of $140 million. The airline said they expect 140 cancellations a day until the planes return. This means that over 14,000 cancelations will occur in the 4th quarter and the beginning of January and the hole that these airlines have found themselves in will only get deeper. American Airlines unfortunately won’t be able to continue their growth plans and will need to start cutting funding to compensate for these cancellations. Airlines are also looking for compensation from Boeing to cover the loss of revenue, however, they have only received flimsy statements “It’s hard until we know when the airplane is really going to be back in service to ascertain what the damages are.” (American Airlines) They also were using the 737 Max a lot “American reports earnings on Oct. 24. The airline had 24 of the 737 Max jets in its fleet at the time of the grounding and has 76 more on order.” This means that the money they used to purchase these planes will not be made back efficiently and that this may put a huge dent into their stock prices. This can be related to our discussions about bonds and how investing in them will yield great profit but has a massive risk involved. Investors may also pull out of Boeing’s stock, as this loss of a huge asset has caused many people to question the company’s management and safety. However, even though Boeing stock did recede, it now is climbing again due to budget cuts and use of older airlines. While this has stopped the massive recession, Boeing’s financial state and management is still a huge mystery.

Boeing paid a $4.9 billion after-tax charge in the second quarter of the grounding to cover their recent improvements to the 747 Max. These improvements include new software and the change of anti-stall systems, as they reportedly pushed the nose of the plane down during the crash. These improvements are still being reviewed by inspectors and the grounding has no timeline yet, meaning the grounding could last for more than a year.

Overall, the grounding has been a massive detriment to the airline revenue and flying may not be the greatest option anymore. Flights are being cancelled constantly and many airlines have to cut cost to make up for the revenue lost within their business.

Personal & Financial Management

10/16/19

Boeing paid a $4.9 billion after-tax charge in the second quarter of the grounding to cover their recent improvements to the 747 Max. These improvements include new software and the change of anti-stall systems, as they reportedly pushed the nose of the plane down during the crash. These improvements are still being reviewed by inspectors and the grounding has no timeline yet, meaning the grounding could last for more than a year.

Overall, the grounding has been a massive detriment to the airline revenue and flying may not be the greatest option anymore. Flights are being cancelled constantly and many airlines have to cut cost to make up for the revenue lost within their business.

Wednesday, October 16, 2019

Writing a Will

Written by: Ros F.

Writing a will may not even seem relevant at this point in your life. You’re young, healthy and have your whole life ahead of you. But in most states, you are able to legally write your last will and testament as soon as you turn 18.

So why write a will? I’m not trying to be too morbid but everyone does kick the bucket at some time or another. And if you don’t have a legally binding will ready when your bucket is kicked, your state’s intestacy laws take over. They will decide how to handle your money, without your say in the matter. If you want to be in control of what happens to your life savings, a will is the way to go.

First, start with the introduction. State your name, address, that you’re over the age of 18, you are of sound mind and are not under duress. It is also customary to include that it is your last will and testament, and that it revokes all other wills that came before it.

Next, appoint an executor. This is someone who will follow the instructions of your will. The executor of your will should someone you deeply trust like a spouse or close friend. Before appointing them, make sure they are willing to accept the role.

The next step is to identify your heir. These are the people who will be your beneficiaries and inherit your wealth. It’s most common for your spouse and children to be your sole heirs but it is also important to add any friends you want to include.

The following step doesn’t pertain to most 18 year olds but parents should name a guardian to take responsibility for any children you may have. Similar to appointing an executor, you should talk to prospective guardian to make sure they understand your terms and confirm their willingness.

Following the appointment of a guardian, it is time to assess and divide. Create a list of your assets: real estate, bank accounts, retirement accounts, stocks, bonds, etc. Then assign your heirs their percentage of their assets that they will receive.

The last and final step is to sign the legal document, as well as three witness to validate the will. Many people feel more at peace after creating a will because they know that even when their gone their closest friends and family will be taken care of and their valuables will be distributed where they wish.

Writing a will may not even seem relevant at this point in your life. You’re young, healthy and have your whole life ahead of you. But in most states, you are able to legally write your last will and testament as soon as you turn 18.

So why write a will? I’m not trying to be too morbid but everyone does kick the bucket at some time or another. And if you don’t have a legally binding will ready when your bucket is kicked, your state’s intestacy laws take over. They will decide how to handle your money, without your say in the matter. If you want to be in control of what happens to your life savings, a will is the way to go.

First, start with the introduction. State your name, address, that you’re over the age of 18, you are of sound mind and are not under duress. It is also customary to include that it is your last will and testament, and that it revokes all other wills that came before it.

Next, appoint an executor. This is someone who will follow the instructions of your will. The executor of your will should someone you deeply trust like a spouse or close friend. Before appointing them, make sure they are willing to accept the role.

The next step is to identify your heir. These are the people who will be your beneficiaries and inherit your wealth. It’s most common for your spouse and children to be your sole heirs but it is also important to add any friends you want to include.

The following step doesn’t pertain to most 18 year olds but parents should name a guardian to take responsibility for any children you may have. Similar to appointing an executor, you should talk to prospective guardian to make sure they understand your terms and confirm their willingness.

Following the appointment of a guardian, it is time to assess and divide. Create a list of your assets: real estate, bank accounts, retirement accounts, stocks, bonds, etc. Then assign your heirs their percentage of their assets that they will receive.

The last and final step is to sign the legal document, as well as three witness to validate the will. Many people feel more at peace after creating a will because they know that even when their gone their closest friends and family will be taken care of and their valuables will be distributed where they wish.

The Importance of Post-College Employment

The Importance of Post-College Employment

Maria Sieb

Economics B2

It’s generally agreed upon that with a college degree comes a higher-paying, more coveted job, right? That’s not always the case. In today’s job market, finding sufficient employment after college graduation is more difficult than it seems.

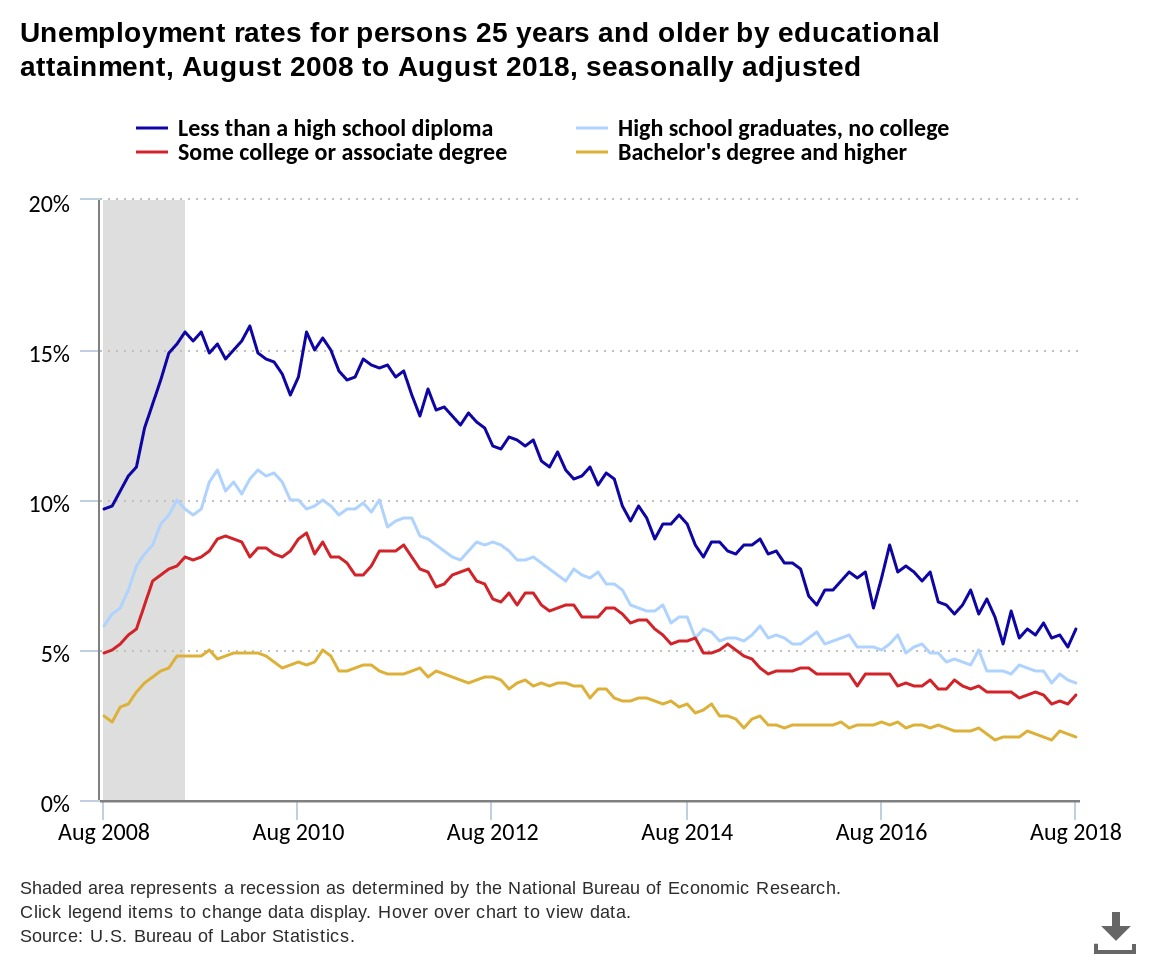

In good news, the unemployment rate for individuals with a bachelor’s degree or higher has gone down from 2.4% to 2.1% in the past year. This means those who earn a college degree have little trouble finding employment after graduation. While this is great, it becomes a bit more complex when you examine the types of jobs these graduates are finding.