Economics Blog Post

New Year, New taxes.

New Year, New Taxes.

On December 22, 2017, President Donald Trump signed the GOPs tax bill into law. One of the biggest new tax credits is the child tax credits. A tax credit is different than a tax deductable, a deductible is a dollar-for-dollar reduction to your tax bill.The tax credit is designed to help parents with an income boost (SmartAsset). So how much is the tax credit? Well this year the tax credit had doubled! The tax credit is going from 1,000 dollars to 2,000 dollars. Therefore families with 1 child will have a $2,000 tax credit, a family of 2 will have a $4,000 tax credit and so on.

An important part of taxes is knowing the difference between refundable and nonrefundable credits. A nonrefundable tax credit can bring the taxpayers bill down to zero dollars. And if you have refundable credit then you can end up with a refund. If your bill is 1,000 dollars and you have 1,500 dollars refundable tax credits then you will have 500 dollars back (The Motley Fool). The $2,000 tax credit is $1,400 refundable for each child. In order to get the credit the dependent must be under 17 years old. They must have a relationship with the taxpayer such as parent, grandparent, adopted child, and so on. Also if you have a child that is over 17 or another dependent, like elderly relatives, then there will be a $500 tax credit.

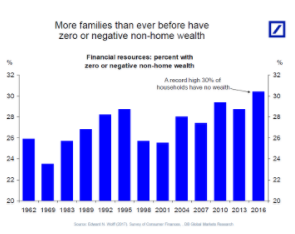

However the trade-off for the increased tax credit is that the personal exemption (up to $4,050), is being removed. The personal exemption was $4,050 and could have been used for you, your spouse, and your dependents, (Up to a certain amount of course.) The child tax credit is supposed to help with the removal of the personal exemption, now the GOP is not able to take the personal exemption off all the way but instead is suspended until 2025. Taking away the personal exemption could have negative benefits for families with three or more children. The child tax credit is an idea of scarcity, families can only have so much money taken away from them to pay to the government and the government needs more money to run the government for the next year. The government will then take this tax money and decide if they should use it for guns or butter, meaning that the country will decide if they should use the money for military good or produce consumer goods. In the table below, you will see the new tax brackets and new tax rates for the 2018 tax year.

In conclusion there are many different tax changes for the 2018 tax year, one of the highlighted ones is the new child tax credits and the removal of the personal exemption for spouses, dependents, and taxpayers themselves. These changes will not be included for the taxes that are due this year in April, as it will affect the taxes that are due next year in April.

How taxes will change depending on a person's income.

Works Cited

Adamczyk, Alicia. “The Basics of the GOP Tax Plan, Explained.” Two Cents, Twocents.lifehacker.com, 27 Dec. 2017, twocents.lifehacker.com/the-basics-of-the-gop-tax-plan-explained-1821583174.

Adamczyk, Alicia. “The Basics of the GOP Tax Plan, Explained.” Two Cents, Twocents.lifehacker.com, 27 Dec. 2017, twocents.lifehacker.com/the-basics-of-the-gop-tax-plan-explained-1821583174.

Frankel, Matthew. “The 2018 Child Tax Credit Changes: What You Need to Know.” The Motley Fool, The Motley Fool, 9 Jan. 2018, www.fool.com/taxes/2018/01/09/the-2018-child-tax-credit-changes-what-you-need-to.asp.

Josephson, Amelia. “Child Tax Credit Guide (2018): How Much Are You Eligible For?” SmartAsset, SmartAsset, 12 Jan. 2018, smartasset.com/taxes/all-about-child-tax-credits.